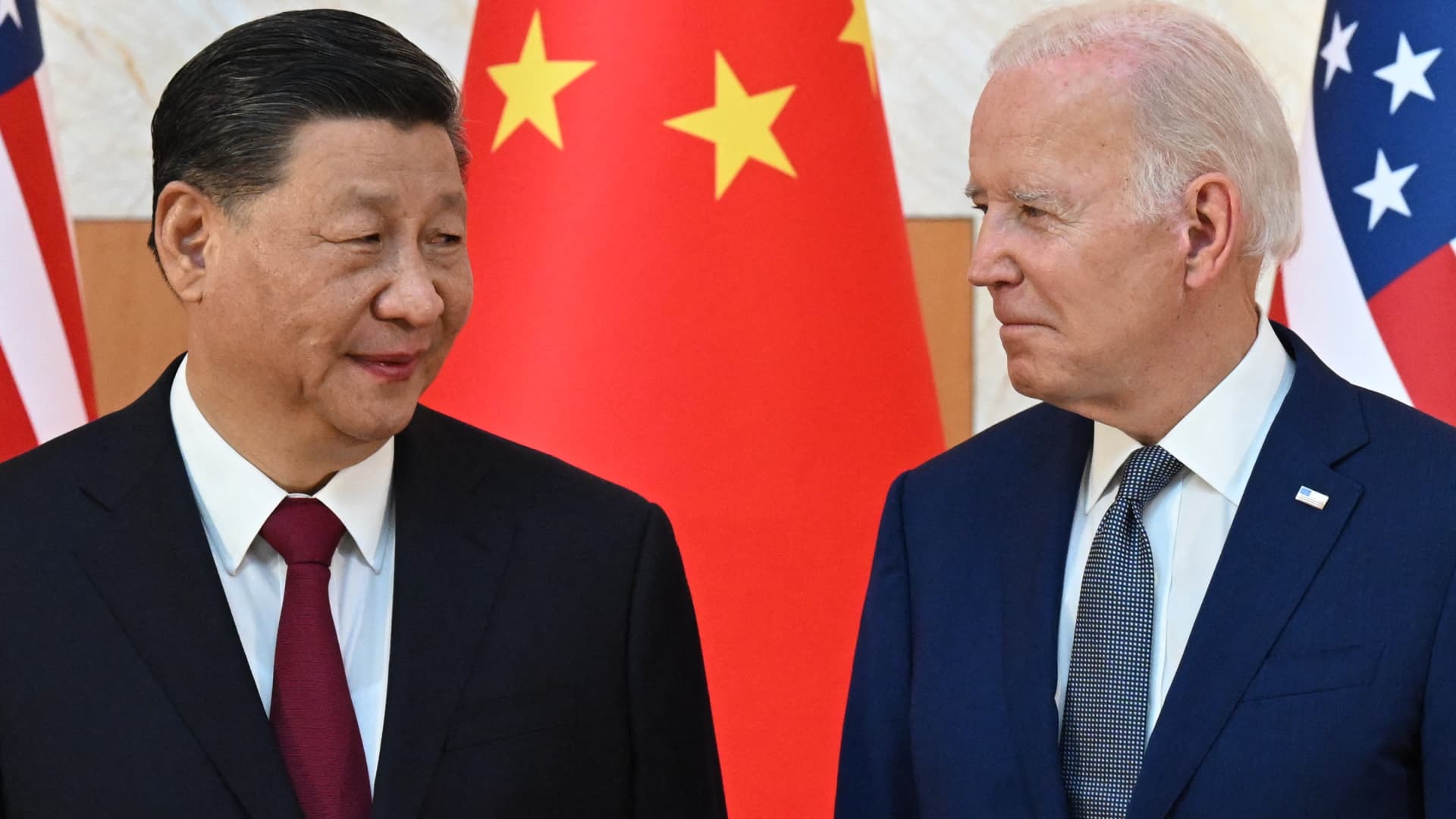

President Joe Biden and his Chinese counterpart Xi Jinping are expected to meet on the sidelines of the Asia-Pacific Economic Cooperation summit in San Francisco in November.

Saul Loeb | Afp | Getty Images

President Joe Biden is calling on the U.S. Trade Representative to triple the China tariff rate on steel and aluminum imports as he makes the rounds in the key battleground state of Pennsylvania.

On Wednesday, the president will visit the United Steelworkers headquarters in Pittsburgh.

Biden’s demand to raise the current 7.5% average tariff on steel and aluminum is an effort to make clear that his administration’s recent warnings about China’s trade practices are not empty threats.

On a visit to China last week, Treasury Secretary Janet Yellen raised concern that Chinese subsidies were creating an oversupply of clean energy products, like solar panels and electric vehicles, that would outpace domestic demand. She worried that overcapacity could be dumped on global markets at artificially cheaper prices, potentially stifling competition.

In an interview with CNBC’s Sara Eisen, Yellen said that tariffs were not off the table if those overcapacity qualms went unaddressed.

Chinese officials and state media have since denied the overcapacity accusation, saying that its abundance of supply of clean energy products is a result of “constant innovations,” not government subsidies.

As China shrugs off the overcapacity concerns, the Biden administration is doubling down on what it perceives as the threat to global trade.

“China’s policy-driven overcapacity poses a serious risk to the future of the American steel and aluminum industry,” National Economic Council Director Lael Brainard said on a call with reporters on Tuesday. “China cannot export its way to recovery. China is simply too big to play by its own rules.”

Biden’s balancing act

Biden’s escalated push to hike tariffs comes as he balances election-year politics with a fragile geopolitical landscape and heightened concerns about the strength of the U.S. economy.

On the one hand, the White House is still working to thaw relations with China after several years of near-frozen communication, in part sparked by former President Donald Trump’s initial round of China tariffs, which almost triggered a full-fledged trade war.

Tariffs can also have unintended economic ripple effects by raising U.S. manufacturing costs that may ultimately translate to higher consumer prices. That would be an unwelcome result during a time when Biden is already in the middle of a yearslong battle to bring down stubborn inflation and prove to voters that his economic agenda is working.

A senior administration official on Tuesday rejected the notion that tariff hikes would lead to higher inflation.

“If taken these actions will not increase inflation, but they will protect American jobs and steel industry,” the official said on a call with reporters. “Residual inflation is not coming from goods, these actions will not change that.”

On the other hand, the Biden campaign is looking to maintain a hawkish China stance as he competes against Trump for blue-collar workers’ votes. In that vein, Biden will also reiterate his opposition to the proposed sale of U.S. Steel to Japan’s Nippon Steel.

“It’s important that U.S. Steel remains a domestically owned and operated company,” a senior administration official said Tuesday. “The president will make that clear again. He has told the steelworkers he will have their backs and he means it.”