The FCA (Financial Conduct Authority) is the financial services regulator in the UK. They are about to launch the ‘Travel Rule’ on 1st September 2023 for crypto assets. This should bring greater transparency to crypto asset transfers.

That sounds good, right? So, why is there controversy over this rule? So, let’s dive in and see what the FCA plans to do with this Travel Rule.

What Is the Travel Rule by the FCA?

In July 2022, the UK saw a change in its money laundering legislation. We can find the origin of this change in October 2021. That’s when the Financial Action Task Force (FATF) updated their VASP guidance. These are Virtual Assets and Virtual Asset Service Providers. The FATF is an international standard-setter.

The Travel Rule is designed to bring greater transparency to cryptoasset transfers, making it harder for criminals to use #crypto for illegal activity.https://t.co/kmB6rgMn5e

— Financial Conduct Authority (@TheFCA) August 17, 2023

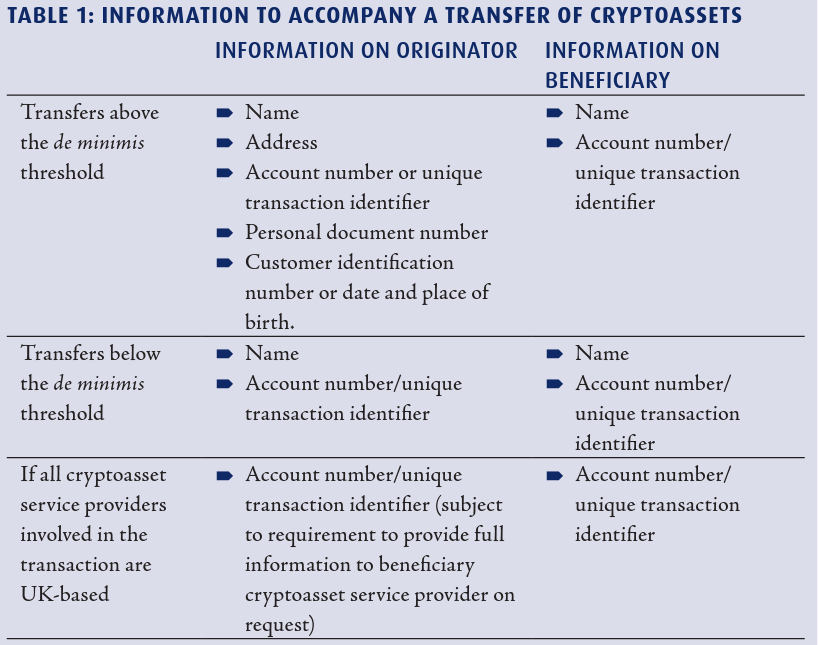

This update included Recommendation 16. This states that: “You need to accompany crypto asset transfers with identifiable originator and beneficiary information.” This is very much like the Travel Rule by the FCA. This rule states that: “Crypto asset businesses in the UK must collect, verify and share information about crypto asset transfers.”

In June, the FATF highlighted that there should be no delays in implementing this Travel Rule. Citing that this could cause all kinds of challenges. As a result, this is what the FCA expects crypto asset firms in the UK to follow, as of 1st September 2023:

- Take all reasonable steps and exercise all due diligence to obey the Travel Rule.

- Firms remain responsible for achieving compliance with the Travel Rule. Even when they use third-party suppliers.

- Fully comply with the Travel Rule when sending or receiving a crypto asset transfer to a firm that is in the UK. This also includes any jurisdiction that has implemented the Travel Rule.

- Regularly review the implementation status of the Travel Rule in other jurisdictions. Adapt business processes as appropriate.

Sending or Receiving Transfers to Jurisdictions Without Travel Rule

When sending transfers:

- UK crypto firms should take all reasonable steps to receive this information.

- In case that’s not possible, they still need to collect and verify the information that the MLR requires. That’s the Money Laundering Regulations. Before they make a transfer, they need to store this information.

When receiving transfers:

- Missing or incomplete information. The UK firm must check the Travel Rule status in said country.

- The UK firm must now assess if they want to make the funds available to the beneficiary.

ICYMI: UK firms must take ‘reasonable steps’ to comply with crypto Travel Rule, FCA sayshttps://t.co/kmkgcMVqp7

— The Block (@TheBlock__) August 17, 2023

Why Is the Travel Rule So Controversial?

The Travel Rule finds its origins in wire transfers. However, wire transfers differ fundamentally from crypto transfers. A wire transfer uses a TradFi institution like a bank. On the other hand, for a crypto transfer, you use a pseudonymous wallet. As a result, crypto transfers don’t have or offer the same information as a SWIFT transfer.

Two senior associates at Clifford Chance LLP wrote an article about the Travel Rule. This was already back in December 2021. They pointed out a variety of reasons why this wouldn’t work well for crypto assets. To carry out a crypto transfer, you need the following information:

- A private key. This verifies the transfer in the sender’s wallet.

- The recipients’ wallet address.

So, what is not included, are the following:

- The name of the wallet owner.

- The name of the beneficiaries’ wallet.

- Location of recipients’ wallet.

In other words, you can’t locate the sender’s wallet. You also don’t know whether the sender is an individual a company or a firm. There are more factors to consider. A SWIFT transfer goes through a system that only a financial institution can access. However, a crypto transfer doesn’t need to go through an exchange. You can transfer assets peer-to-peer. The picture below shows a recap of the required information for a crypto transfer.

P2P Transfers

As a result, P2P transfers are not included in the Travel Rule. However, a UK-based crypto firm has no reliable way to find out if they’re dealing with an individual or a firm. They also don’t know the wallet’s location. Even in case the wallet owner provides this information, how can they confirm this?

So, the Travel Rule seems to work well for centralized institutions. However, for a pseudonymous transaction, this doesn’t work too well. Furthermore, it took over a decade to install a system that worked for TradFi. Think of SWIFT. For crypto assets, there’s not that much time allowance to put an adequate system in place. Rather, the FCA tries to enforce a system in the crypto space, that’s meant for a different financial sector. That’s TradFi and fiat transactions.

Conclusion

The FCA is about to introduce the Travel Rule for crypto assets. This rule has its origins in TradFi and fiat transactions. It works well for centralized institutions. However, for pseudonymous crypto transfers, it doesn’t work that well. Nonetheless, the FCA plans to launch the Travel Rule as of 1st September 2023 for the crypto space.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.

Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post FCA Comes With a Controversial Crypto Travel Rule appeared first on Altcoin Buzz.