The crypto space is a dynamic environment. Coins that are hot during one month, can be out of sight the next month. That’s why you need to keep track of the crypto space in general. Especially considering that September is historically not a good month for crypto.

That’s why we picked 5 top coins for September. So, we look into the top 5 crypto coins to watch in September, Part 2. These 5 coins may do well during next month. Here is the first part.

August is usually a bad month for Bitcoin but September is even worse.

What is promising is the last quarter of the year often is a very bullish period for the orange coin

h/t @coinglass_com pic.twitter.com/Kv1CYwOjTg

— Tom Dunleavy (@dunleavy89) August 25, 2023

1) Pendle (PENDLE)

Pendle is a permissionless yield-trading protocol. You can execute a variety of yield-management strategies. September is historically a bad month for crypto. That implies that Pendle will do well in the current and expected sideways market.

1/ Banking on LSTs as their growth catalyst. @pendle_fi's set to be DeFi's next blue-chip.

Their recent product expansion, Pendle Earn, opens the gate to mass adoption. WAGMI!

A

on Pendle, its Earn product, and the bull case (1/16)! pic.twitter.com/yAVtUHeSvE

— archipelabro | mimi (@archipelabro) August 28, 2023

The finance hype settled, and the current PENDLE price of $0.613 is a good entry. Over the last year, PENDLE is up by, 1071%. Now, Pendle gives you extensive control over your yield. It gives you plenty of options to exit, hedge, or even prolong your yield.

If you lock PENDLE, you earn the vePENDLE token. There’s a max locking period of 2 years. Now, the vePENDLE token boosts your APY in LPs (liquidity pools). You also share in protocol revenue, and you receive swap fees from voted pools. Pendle offers three mechanisms for this:

- Yield Tokenization

- Pendle AMM

- vePENDLE

Here’s an explanation of how Pendle works, from an earlier article.

Pool Highlights

RWA pools offer some of the highest yields on stablecoins with zero IL

GLP pool yield spikes as traders rush to position for the weekly yield update, which is projected 4.44% now

swETH by @swellnetworkio leads the APY charge for naked ETH LSD pools pic.twitter.com/riOAevBpts

— Pendle (@pendle_fi) August 28, 2023

2) Astar Network (ASTR)

Astar Network joined the recent headlines with a massive partnership with Sony. It’s a Japanese project, founded in January 2019 by Sota Watanabe. You may have heard of Plasm Network, but it rebranded to Astar in June 2021. It’s a smart contract platform for Web 3.0 dApps.

Even in the bear market, parachain auctions continue.

We're happy to share that we'll be renewing our slot soon.

Stay tuned

https://t.co/nLsh0DehyY

— Astar Network (@AstarNetwork) August 27, 2023

Astar is a Polkadot parachain. However, it supports both Ethereum Virtual Machine (EVM) and WebAssembly (WASM) virtual machines. Furthermore, it offers Layer 2 scaling solutions, including Plasma and zero-knowledge rollups. It has cross-chain interoperability.

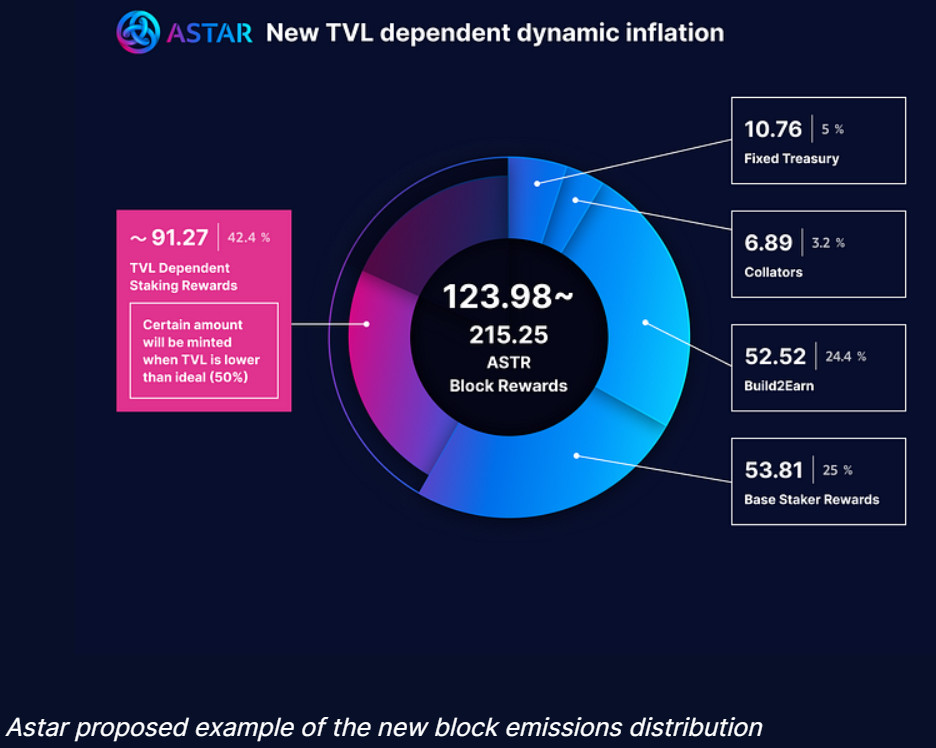

The project had an overhaul of its tokenomics and boasts dynamic inflation. This means that inflation adjusts each year, based on the total supply and TVL. The native token is ASTR. It has three main functions:

- Pay for network fees.

- Staking

- Dapp staking.

The picture below shows the new tokenomics 2.0.

Source: Astar blog

3) Sui (SUI)

The hype around Sui is settling. In the meantime, its ecosystem saw solid growth. For a new chain, there’s a lot of competition, including from Aptos. However, Sui is not sitting still.

Check out Tails By Typus, a new dynamic NFT collection utilizing Sui Kiosk. https://t.co/Sx506CqsaN

— Sui (@SuiNetwork) August 28, 2023

The SUI price went down compared to the launch. The token distribution saw some hick ups and many early users were not happy about this. Still, there’s no big unlock until March/April 2024.

One of the things in which Sui stands out is its transactions. You can add various actions to one transaction. In their Move coding language, they allow for parallel transactions. Recently, Sui also added liquid staking. This allows for extra revenue of locked/staked tokens. Five more primitives are on their way to Sui. These include, for instance:

- zkLogin.

- PasskeyN.

- Confidential NFTs.

We are hosting another Sui Liquid Staking twitter spaces – this time with some of the top DeFi protocols on @SuiNetowk.

#Sui #Suinami #SuiEcosystem #Bullshark pic.twitter.com/aFatm4Hawy

— Aftermath Finance (@AftermathFi) August 21, 2023

4) SingularityNET (AGIX)

AI has taken the market by storm. This includes the crypto AI market. SingularityNET is currently the best protocol in this field. The team delivers its roadmap. It is a decentralized AI marketplace. This means that you can use their growing AI codebase and add the AI that benefits your project best.

We are thrilled to announce a strategic partnership with @vechainofficial to advance data-driven sustainability technology and deliver enterprise-quality AI solutions to help businesses embrace the combined values of blockchain and AI:https://t.co/ks18SnoVxs

— SingularityNET (@SingularityNET) August 25, 2023

One of their upcoming milestones is the AGI-as-a-service. That is artificial general intelligence. This represents generalized human cognitive abilities in software. In other words, faced with an unfamiliar task, AGI will find a solution. This means that AI combined with AGI will be able to perform any task a human being can do.

The AGIX price is up by over 300% over the last year. Here is a deep dive into SingularityNET. The following video is a short intro to Singularity

5) Arweave (AR)

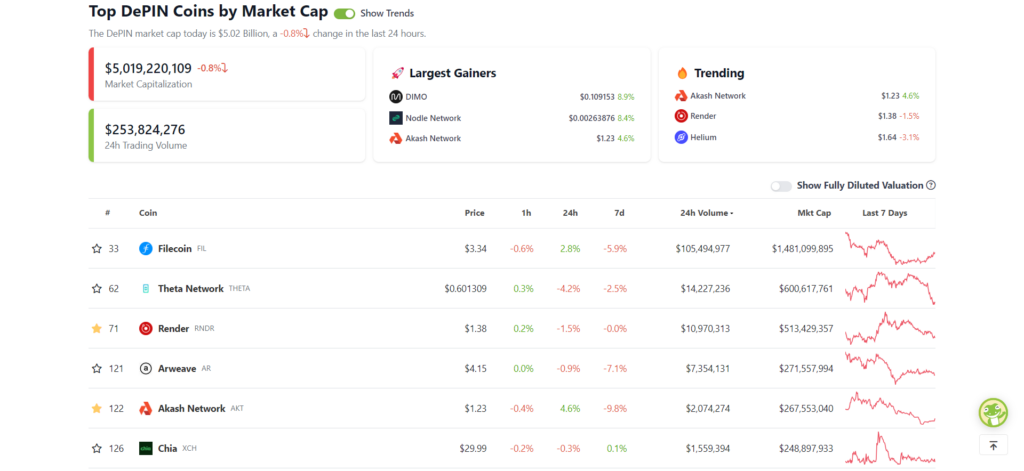

Arweave is all about storage. With the amount of data that we, as humans, produce each day, we need lots of digital storage space. Currently, there are two storage protocols that stand out, Arweave is one of them. The other protocol is Filecoin. However, Arweave has by far the better tokenomics and UI UX (user experience).

The dePIN (Decentralized Physical Infrastructure Networks) sector is on the rise. The picture below shows the current top 6 in dePIN by market cap.

Source: CoinGecko

As we see it, from these coins, Filecoin suffers from inflation and has a bad UX. Theta seems to be a lost cause that requires a lot of hardware support. RNDR and AKT are GPU-related and will be strong next run. This leaves the road wide open for Arweave to overtake Theta’s market cap soon.

Conclusion

We looked at 5 coins to watch in September. This included RNDR, ASTR, SUI, AGIX, and AR. We gave the reasons why we keep an eye out on them in September.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.

Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post Top 5 Coins to Watch in September – Part 2 appeared first on Altcoin Buzz.