The SEC is heating up its quest against crypto. They keep filing lawsuits, seemingly on the go. However, some of these lawsuits already backfired. We saw XRP and Grayscale with wins over the SEC in US courts. This effectively heightens the chance for BTC to spot ETF approvals.

So, what can you do with your Bitcoin when its price goes up due to the acceptance of the BTC spot ETF?

BREAKING NEWS

Grayscale wins over SEC in landmark ruling for Spot #Bitcoin ETF!

This is a huge victory for the crypto community and a major step towards mainstream adoption.

This Bull-run will be massive! It will be fueled by both Institutions and… pic.twitter.com/fkvhSi1n9G

— Seth (@seth_fin) August 29, 2023

1) Research and Due Diligence

Whether it’s for your Bitcoin or any of your altcoins, you should always do research and due diligence. So, let’s take a closer look at these two features. When you do research, there are a variety of factors to look for. You can make your life easier, by using specific research tools. For example,

- Market trackers – CoinGecko and CoinMarketCap are good samples. They show real-time price updates, data on trading volume, market caps, and much more.

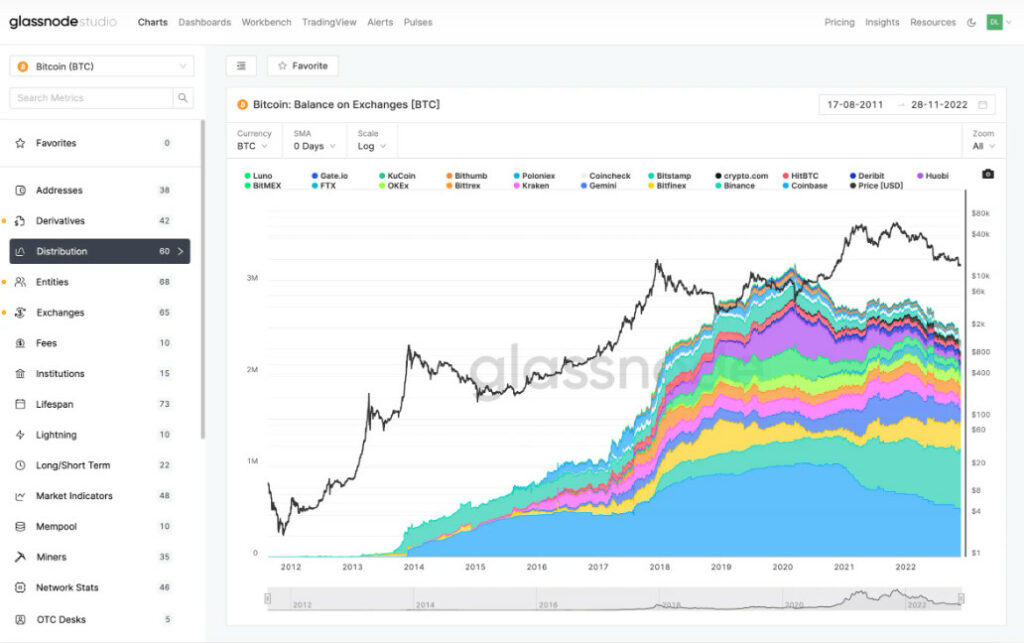

- Data aggregators – For example, TradingView or Glassnode. They offer in-depth analysis.

- Podcasts – Learn from experts.

- Forums – For instance, Reddit or Discord. Find answers to any questions you may have about a project.

- New websites – Like Altcoin Buzz. They help you understand complex matters.

On the other hand, due diligence is almost like fundamental research in a project. Your goal is to confirm facts about a project. This can be, for instance:

- Purpose and use cases – What problem does the project solve and is there a market for it?

- Team information – Who is in the team and what are their credentials?

- Competition – Can it hold up against its competitors?

- Community – Does the project have an active and enthusiastic community?

- Funding – How is the project funded and does it have a good financial track record?

Below is a picture of a Glassnode UI.

2) Diversification and Asset Allocation

Diversification is important for your portfolio. You would rather not have all your eggs in one basket. Bitcoin is a good choice and deserves a spot in each portfolio. However, having said that there are plenty of good altcoin projects out there.

In the top 10 or 20 by market cap, you can find solid projects with low risk. Although, there’s no guarantee that these projects can’t collapse. Remember how fast LUNA went down to almost zero? If you go further down this list, to #100, you find low to medium-risk projects. The higher the number by market cap is, after #100, the higher your risk becomes. However, the rewards can also be higher compared to lower-risk projects.

Your asset allocation is also of importance. Diversification is important for your portfolio. You would rather not have all your eggs in one basket. Bitcoin is a good choice and deserves a spot in each portfolio. However, having said that there are plenty of good altcoin projects out there.

2/ Building a Profitable #Crypto Portfolio: Diversification Tips

1⃣ Balance risk: High, medium, and low-risk investments for gains and losses.

2⃣ Embrace liquidity: Hold stablecoins for quick gains or exits on DeFi.

3⃣ Stay adaptable: Rebalance based on market fluctuations.

— Metrade (@metradeapp) August 28, 2023

In the top 10 or 20 by market cap, you can find solid projects with low risk. Although, there’s no guarantee that these projects can’t collapse. Remember how fast Luna went down to almost zero? If you go further down this list, to #100, you find low to medium-risk projects. The higher the number by market cap is after #100, the higher your risk becomes. However, the rewards can also be higher compared to lower-risk projects.

3) Asset Allocation

Your asset allocation is also of importance. You want to get the most out of your returns. Meanwhile, you want to have the lowest risk exposure. In other words, make sure your cryptos differ from each other. You also want to look at some larger cap coins. They have a lower risk. On the other hand, low-cap coins can give high returns but may have a higher risk. A well-balanced portfolio can look like this:

- 60% large-cap.

- 20% mid-cap.

- 10% small-cap.

- 5% stablecoins.

- 5% NFTs.

How many #tokens do you own in your portfolio?

— CoinMarketCap (@CoinMarketCap) August 25, 2023

4) Stay Informed and Monitor Performance

Staying informed about the latest crypto news is also important. There are many outlets that cater to this. X (former Twitter) is one of them. Crypto Twitter is a useful source of information. For example, each crypto project has its own account. YouTube, Discord, and Reddit are other good news sources. Furthermore, you can go to the project’s websites and follow their social media.

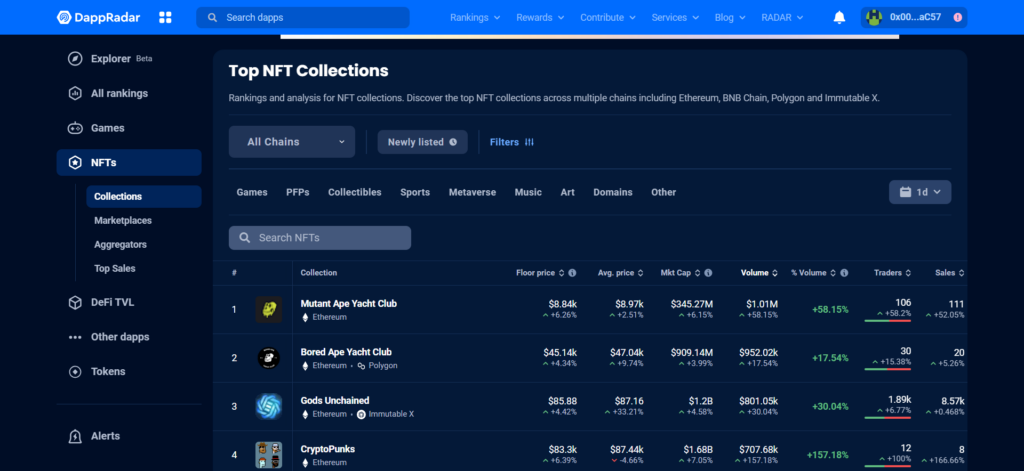

There are also sites available, that allow you to monitor performance. For example, DeFiLlama follows TVL in DeFi. DappRadar is a great source to follow NFT performances. The following picture shows the top NFT collections on DappRadar.

Source: DappRadar

Conclusion

The likelihood that BlackRock and others get their BTC spot ETF approved, increased. The SEC lost a lawsuit against Grayscale. Once the SEC approves these BTC spot ETFs, the Bitcoin price is most likely going to surge. We discussed how you can best prepare for this.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.

Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post 3 Things to Do After the BlackRock BTC Spot ETF Gets Approved appeared first on Altcoin Buzz.