Tether’s CTO, Paolo Ardoino, reveals that the company bought more US Treasury bills than the United Arab Emirates, Australia, Japan, and Mexico.

In a post on X (formerly Twitter), Ardoino highlights that Tether’s current hold in the US Treasury bills is $72.5 billion.

In his tweet, the chief technology officer highlights the relevance of USDT in emerging markets since the stablecoin can provide communities with a “lifeline to protect themselves” against the rampant inflation in their national currencies.

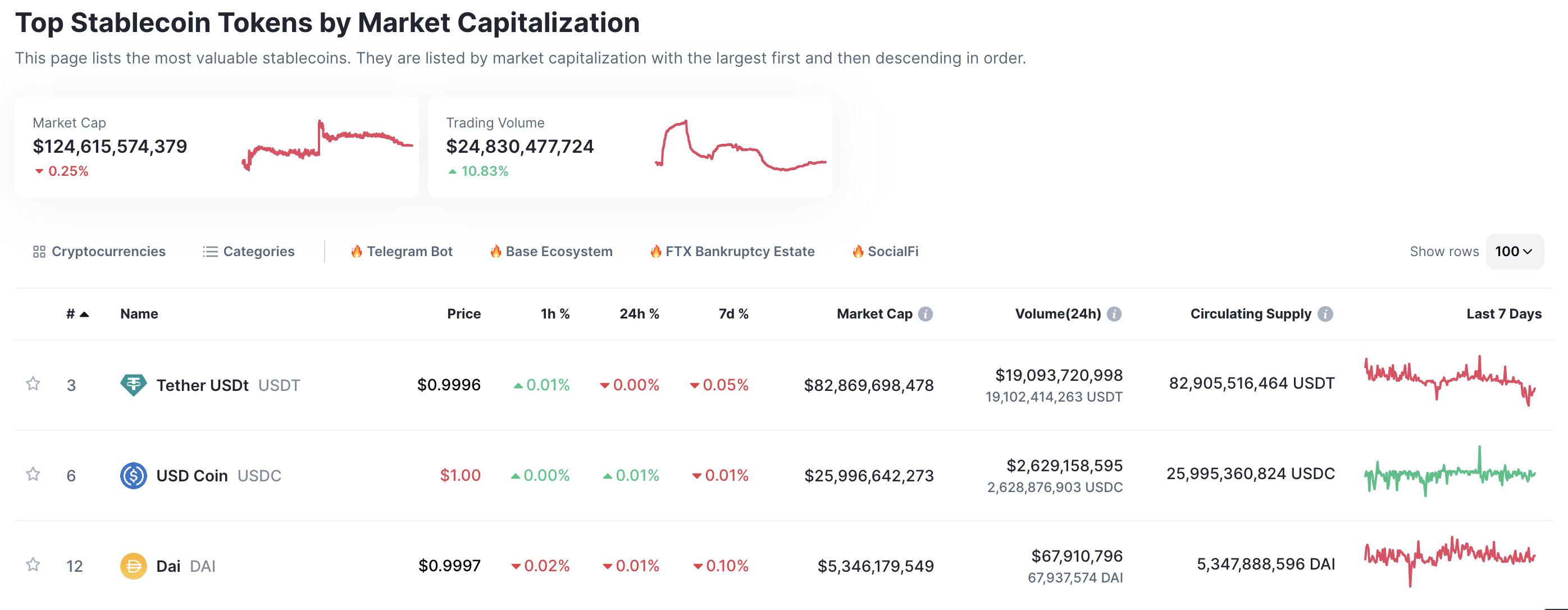

The stablecoins have proven to hold significant weight in the market, with $125 billion in circulation in early September and large institutions like PayPal releasing their own stablecoins.

Therefore, Paolo Ardoino’s post about holding T-bills acts as a level of reassurance to the community since T-bills are short-term debt obligations backed by the US government and represent an equivalent asset to the stablecoin they represent.

At the time of writing, Tether is the top stablecoin by market cap, according to the crypto stats website CoinMarketCap.

Despite regulatory uncertainty in the crypto market, Tether continues to expand its reach as the world’s most used stablecoin.

Just one week earlier, on Aug. 29, Tether added a private bank in the Bahamas, Britannia Bank & Trust, as a partner for processing dollar transfers on the platform.