LSDfi is an upcoming niche in DeFi. These are various protocols centered around liquid staking derivatives. They also use a variety of DeFi use cases. Hence, the name LSDfi.

Despite the current bear market, some LSDfi tokens perform well. Even better, there’s still room for improvement. So, let’s take a look at some of them.

Tokens that performed well during this bear market and still have room to grow to make you money:

Telegram bots$UNIBOT – Leader$BB – Sports betting$NEWS – news trading$PVP, $HIPVP – TG gambling#MEVFREE – MEV tools$NEOBOT – wallet analysis$BAG, $SHIELD – raid

Common… pic.twitter.com/LrSwoR2oXM

— Crypto Gideon

(@CryptoGideon_) September 5, 2023

1) Lybra Finance (LBR)

Lybra Finance offers an interest bearing stablecoin, eUSD. You can deposit your ETH or stETH (Lido Staked ETH) as collateral. This allows you to borrow eUSD with a collateral of up to 170%. The platform doesn’t charge any fees for minting eUSD or interest on the borrowed amount.

The eUSD stablecoin pegs close to the USD. Lybra handles this with four mechanisms:

- Overcollateralization.

- Liquidation mechanisms.

- Arbitrage opportunities.

- The eUSD premium suppression mechanism.

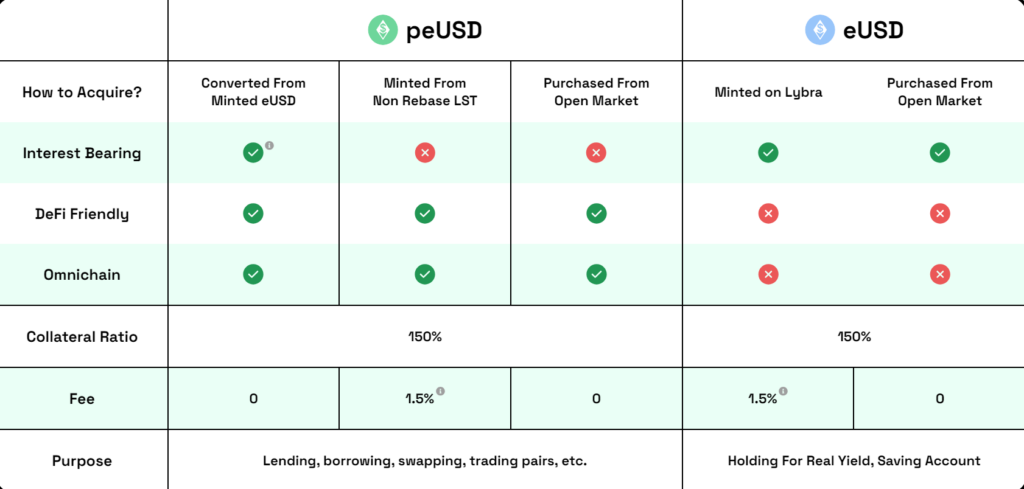

The APY for staking eUSD is around 8%. However, you can also convert your eUSD into peUSD. Now you can use this peUSD in DeFi protocols. At the same time, you still earn interest on the deposited collateral. You can convert peUSD back to eUSD at any time.

The LBR governance token did well since Lybra launched in April 2023. Towards the end of May, it reached its current ATH of $4.48. That’s well over a 2000% gain from its all-time low. The current LBR price is $1.31. The picture below shows the peUSD vs eUSD chart.

Source: Lybra website

2) Pendle Finance (PENDLE)

Pendle Finance offers two main products. That’s Pendle Earn, which allows you to earn a fixed rated yield in an easy way. This guide shows you how it works. There’s also the option to earn on future yields on ETH staking. Pendle does this with a variety of liquid staking options.

The protocol works on three chains, Ethereum, Arbitrum, and the BNB chain. It offers three main features:

- Yield tokenization – Pendle splits every yield-bearing token into two tokens. A yield and a principal component.

- Pendle AMM – trade yield with marginal impermanent loss.

- vePENDLE – lock up PENDLe and get a stake in the protocol.

In other words, Pendle also offers you to receive derivatives of derivatives. You can tokenize and trade yield. This opens the doors to advanced yield strategies in a straightforward set-up. Pendle also offers High Yield Liquidity Pools (LPs). Plenty of options are available on this platform. This makes it one of the top LSDfi platforms.

Pendle is being tracked under both "Real World Assets" and "LSDfi" on @Coingecko now! https://t.co/xPRP9z38vM

— Pendle (@pendle_fi) September 8, 2023

3) ZeroLiquid (ZERO)

How about a protocol that repays your loans for you? Well, say hi to ZeroLiquid. So, your collateral generates yield and this yield pays your loan for you. This comes with 0% interest and no liquidations.

So, this is how it works. You collateralize your LST and you mint zETH. This zETH anchors to the ETH price. In other words, any price volatility for ETH, zETH syncs it. As a result, there’s no liquidation possible. For this service, ZeroLiquid takes an 8% fee from the yield. However, through governance ruling, this percentage can change.

This sounds great, but keep in mind that ZeroLiquid is only in the testnet phase. There are some issues to keep an eye out on:

- Low LTV (the ratio of your Loan to Value of your collateral).

- The fee that ZeroLiquid takes is rather high.

- How can zETH anchor to ETH?

Our Zero Gravity mission to Mars has launched

A

on why we're going to Mars and how you can join us on this epic, 140-million mile trip and receive $ZERO rewards for your contribution

pic.twitter.com/x60cRqUrKn

— ZeroLiquid (@ZeroLiquid_xyz) September 2, 2023

Well, governance can deal with the first two issues. The anchoring needs a bit more fine-tuning. Nonetheless, the concept is great and has potential. You can get an instant loan without having to sell your crypto. The picture below shows how the protocol works.

4) Flashstake (FLASH)

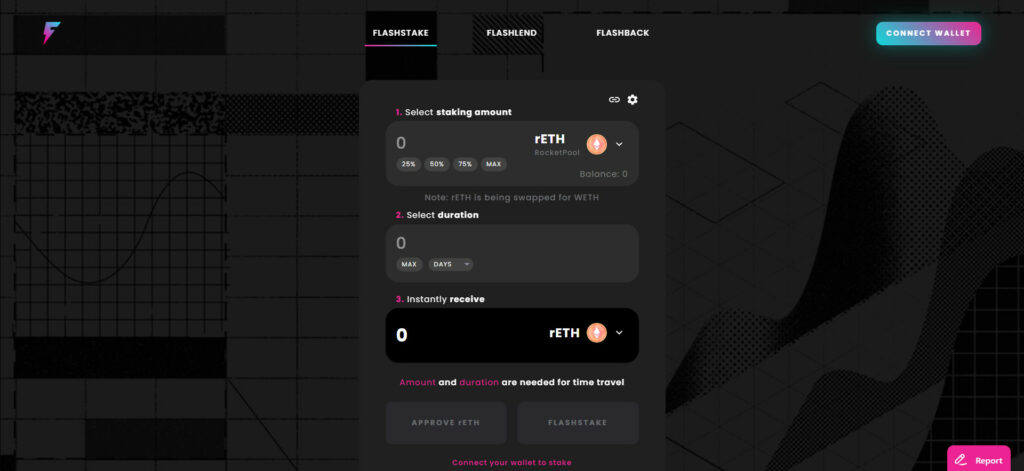

Flashstake allows you to receive your future yield. So, let’s say you stake 10 ETH with Lido for 180 days. This will also give you 10 stETH. You can get the staking rewards of 0.37 ETH right away.

Now, your tokens will remain locked during the staking period of 180 days. If you want your principal back, you will have to repay the yield for the remaining locking period. This yield comes from a variety of pools. For this, Flashstake uses Time Vaults. Currently, the most popular pools are, for example:

- Yield Pools.

- Liquidity Pools.

- Boost Pools.

Here you can find a guide on how this works. In these docs, you can also find information about two other features of the platform. These are Flashlend and Flashback.

Source: Flashstake app

Conclusion

LSDfi is starting to make waves. It’s a growing market inside the DeFi space. We dug a bit deeper into four popular LSDfi protocols. These are Lybra Finance, Pendle Finance, ZeroLiquid, and Flashstake.

– For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

– Unlock the key to managing your crypto portfolio like a PRO! Our top analysts bring you exclusive insights and the latest updates on cryptocurrency trading. Join Altcoin Buzz Alpha on Youtube or Patreon for just $15/month!

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post Top LSDfi Coins That Performed Well This Bear Market appeared first on Altcoin Buzz.