To find crypto gems that can do 100x or 500x or more, you need to co-research. Researching new projects also involves a fundamental analysis. This is where you find out the background and foundation of each project. We offer you a breakdown of fundamental analysis.

There are many facets involved in such a crypto gems analysis. However, be aware that you may not find all the aspects mentioned in this article. Nonetheless, it’s a solid foundation of what you should be looking for.

People will charge you +$1000 to explain to you how fundamental analysis works.

Here is a thread completely for free.

This is the exact same analysis I do for each project I invest in that gave me 500x on average.

No fancy shit, only real insights. Save it, share it.

Thread!pic.twitter.com/HB1DcwBuJK

— Blackbeard (@blackbeardXBT) October 30, 2023

What Are the Aspects of a Fundamental Analysis?

Fundamental analysis for crypto gems involves many aspects. They all cover different grounds. However, they all serve one goal, how to find crypto gems that can do 100x to 500x. So, let’s take a look at them.

Technology and Development

This is the first and also one of the key features to look for in a project. It shows the potential of a project and how successful it can be.

- Check on the developer’s activity. Are they actively building?

- How’s the scalability of the project?

- What security features are in place?

- Does it have a unique innovation?

What Problem Does It Solve and Use Cases

This is another important question to ask. What problem does the project solve, and does it have use cases? A good use case will guarantee demand for the project. People become interested in a project when it solves a real-world issue. The same goes when it improves an existing procedure.

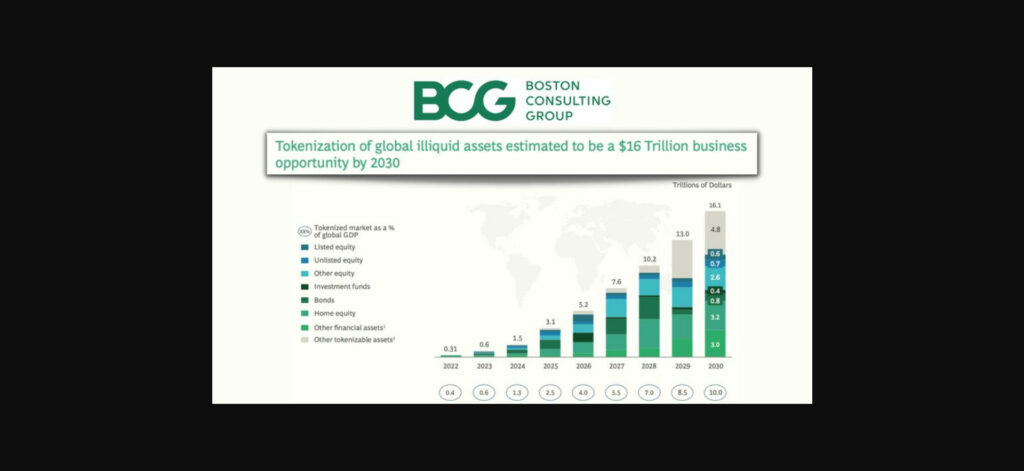

A sample is the up-and-coming RWA niche in crypto. Tokenizing assets may be the key to mainstream crypto adoption. The expected growth of this market can reach $16 trillion by 2030. See the picture below as an example:

Source: Twitter

The Target Market and Competitors

Asses the market and determine if there’s demand for the project. Check the size of the market and if this market can grow. You also need to find out about the competition. The more their product stands out, the higher the chance of success will be.

The Team

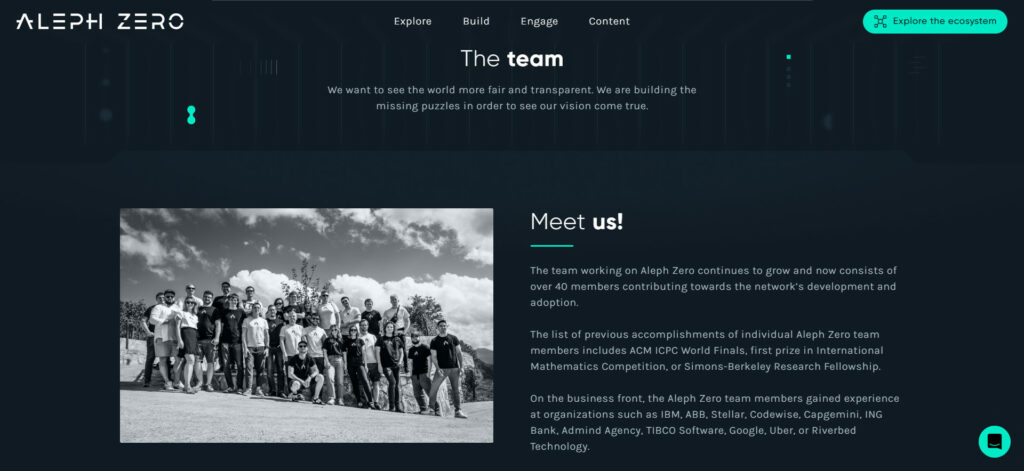

Is the information on the team available? If so, how qualified and experienced is the team? Do they have a background in blockchain technology or cryptography? That’s of course, besides their track record in their field of expertise. Can they deliver what they promise and deliver on the roadmap? A great sample is the Aleph Zero team, see the picture and info below. An anonymous team or missing team information is in most cases a red flag. Here is an example:

Source: Aleph Zero

Tokenomics

The tokenomics is important. Have a thorough look at the token:

- Supply.

- Distribution.

- Allocation.

Make sure you understand what the use cases for the token are. For example, this can be for staking, paying transactions, or governance.

Partnerships

Does the project have strategic or other partnerships with other projects? This can be of importance for adoption. It also raises a project’s visibility.

Social Media

Is a project active on social media. For example, on X, Discord, or Telegram. Is there a good and active community that supports the project? Does the team interact with the community, and can they handle criticism?

Roadmap

A roadmap shows what a team already delivered and what lies ahead. You need to find out if a team can meet milestones. Do they deliver, or is there always a delay? How does the team adapt to changes? Here is an example:

Introducing a brand new development roadmap for Secret Network.

This plan aims to increase interoperability with EVM chains, integrate additional cryptographic technologies, and overall position Secret as a leader in web3 confidentiality.

— 𝕊ecret Network

(@SecretNetwork) October 26, 2023

Communication and Transparency

Is the team’s communication transparent? Check if the communication is clear and frequent. If so, this is a positive sign. For example, in the field of,

- Operations.

- Development progress.

- Financials.

- Prospects.

Funding

Does the project have any funding, or is it backed by VCs? Were there any funding or seeding rounds? If so, how much did the team manage to raise? This tells a lot about the sustainability of a project. You also want to check how the team manages the funds. Check allocations for sustainability. Like, how will it raise revenue? Will the project be able to survive one or more bear markets with its funds? For example, for,

- Development.

- Marketing.

- Or any other purposes.

Market Cap

The market cap states the value of a project. Compare the market cap to its competitors. This metric also provides insight into the project’s growth potential.

On-Chain Metrics

The on-chain metrics tell you how about the projects’ usage. This informs you about the health of a project and if people actually use it. You’re seeking information on, for instance,

- Number of active wallets.

- Transaction volume.

- Number of holders.

Conclusion

If you want to do research on crypto gems, you need to perform fundamental analysis. This consists of various aspects. We cover the most important ones in this article. However, be aware that you may not find all the information for each project.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post How to Detect Crypto Gems With Great Potential appeared first on Altcoin Buzz.