Decentralized exchange Sushiswap (SUSHI) has introduced a new tokenomics model for sustainable growth and efficiency that the community is now discussing.

Launched in August 2020, SUSHI is a decentralized finance protocol on Ethereum (ETH) that allows cryptocurrencies to be traded through liquidity pools without a central authority.

The SUSHI community is evaluating a new tokenomics model aimed at sustainable growth and eliminating current inefficiencies. This revised model offers improved liquidity incentives, revised staking mechanisms, and diversified revenue sources focusing on protocol sustainability and increasing token utility.

The community is invited to provide feedback and vote on whether to adopt this new model or keep the current one.

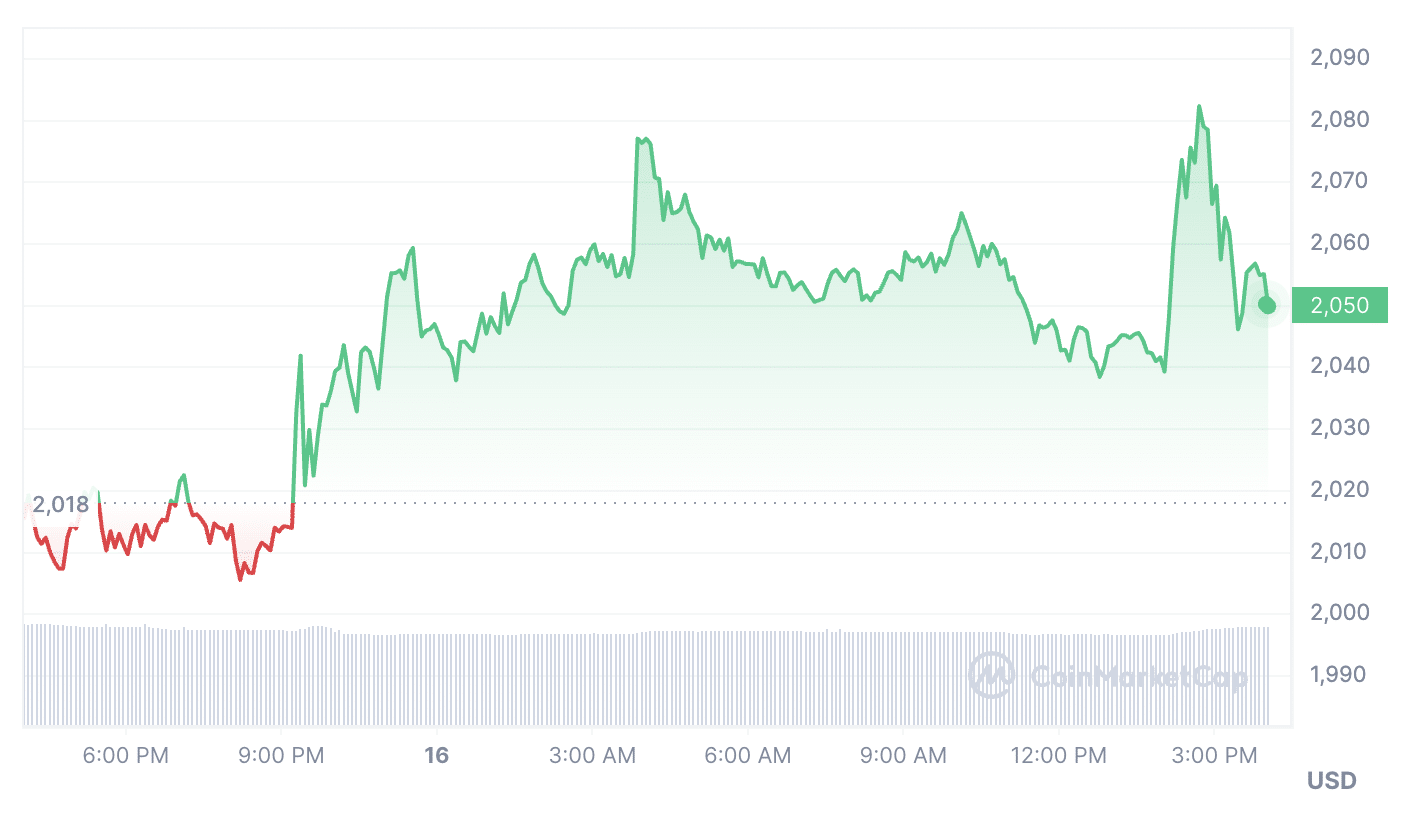

Amid the new initiative, the SUSHI token has risen 8.36% over the past 24 hours to $1.13. Trading volumes over 24 hours increased by 189.32% to 189.32%. The market capitalization also rose 8.92% to $263,265,353, according to CoinMarketCap.

In early November, SushiSwap CEO Jared Gray published a proposal to improve the tokenomics of the project. He stated that SushiSwap is currently experiencing some difficulties. In particular, he pointed to incentives for SUSHI liquidity providers, the mismatch between issuance and revenue, and low xSUSHI staking rates.

Gray noted that the platform team wants to align tokenomics with all stakeholders, including liquidity providers, xSUSHI holders, and traders.