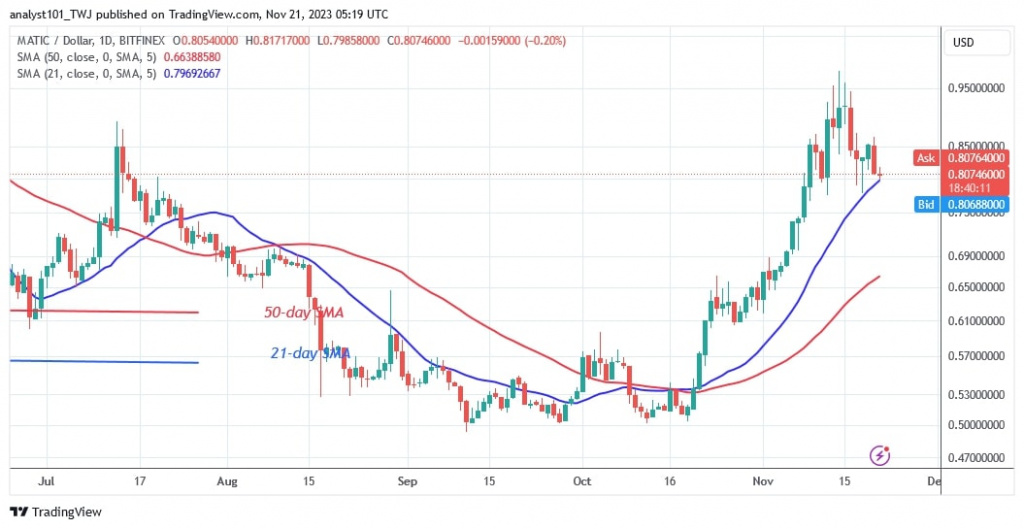

Polygon (MATIC) price has reached bullish exhaustion with a high of $0.98. MATIC price falls back to its previous lows.

Polygon Price Long Term Prediction: Bullish

The altcoin dropped first and found support above the moving average lines. The bearish momentum is now repeating itself as the bears retest the 21-day moving average line. At the time this article was written, the market price of MATIC was $0.80.

On the downside, selling pressure will pick up again if the bears drop below the 21-day SMA. MATIC will then fall even lower to $0.66.

However, if Polygon retraces and finds support above the low of $0.66, the crypto could return to a sideways trend.

Polygon indicator analysis

The price bars on the 4-hour chart have fallen below the moving average lines, indicating that the cryptocurrency will continue to fall. The altcoin is expected to fall due to an overbought scenario. On the 4-hour chart, the 21-day SMA is lower than the 50-day SMA. This indicates a bearish crossover, which means that the cryptocurrency could fall.

Technical indicators

Resistance levels: $1.20, $1.30, $1.40

Support levels: $0.60, $0.40, $0.30

What is the next step for Polygon?

MATIC has been trading between $0.78 and $0.95 since the cryptocurrency collapse. The price indication has shown that the cryptocurrency will continue to fall. The altcoin reversed to the upside and retested the candlestick body of the 61.8% Fibonacci retracement level on November 18. The correction suggests that MATIC will fall to the 1.618 Fibonacci extension or $0.66.

Coinidol.com wrote previously that Polygon retested the $0.95 price level on November 14.

Disclaimer. This analysis and forecast are the personal opinions of the author and are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol.com. Readers should do their research before investing in funds.