The total value locked (TVL) on the Base layer-2 network spiked to more than $400 million since the launch of the Aerodrome decentralized exchange.

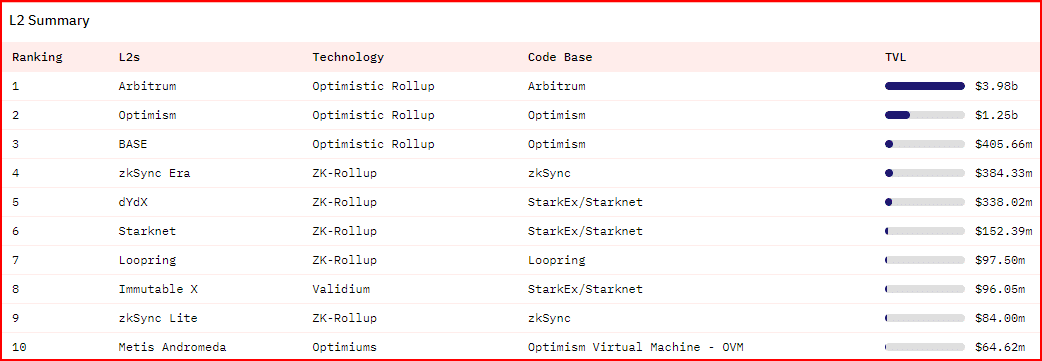

The most recent information from DefiLlama shows that the TVL of Base, a layer 2 Ethereum (ETH) network developed at Coinbase, increased by more than 56% to reach $405.66 million in the past week.

This increase was powered mainly by the introduction of Aerodrome, a new trading and liquidity marketplace, on the network.

Aerodrome got off to a sluggish start when it launched on Aug. 28. It brought in less than $5 million in liquidity over the course of its first two days. However, since Aug. 31, deposits started to grow, eventually reaching more than $170 million in just 24 hours.

With a TVL of $189.6 million, Aerodrome now accounts for nearly half of the TVL on Base. It has also enabled the network to jump ahead of zkSync Era to become the third-ranked L2 in terms of TVL after Arbitrum and Optimism (OP).

What is Aerodrome?

Aerodrome is a fork of Velodrome Finance, the largest DEX on Optimism in terms of revenue and TVL. Speaking to the media in the aftermath of Aerodrome’s most recent surge, the Velodrome development team described Aerodrome’s performance as a “validation” of its belief that ecosystem native DEXs can thrive.

Solidly, the decentralized exchange on which Velodrome and Aerodrome are based was heavily criticized upon its first introduction, when faults in its code and issues with its token incentives structure drove customers and liquidity providers away. However, with Aerodrome, the Velodrome team claims they have fixed Solidly’s flaws.

Velodrome had a TVL of $163.36 million at the time of writing, according to DeFiLlama. This is more than $26 million lower than Aerodrome, although due to its longevity, Velodrome has a much higher annualized revenue at $36.67 million, compared to Aerodrome’s $2.6 million.