Wang Zhao/AFP/Getty Images

Apple and Tesla cracked China, but now the two largest US consumer companies in the country are experiencing cracks in their own strategies as domestic rivals gain ground and patriotic buying often trumps their allure.

Falling market share and sales figures reported this month indicate the two groups face rising competition and the whiplash of US-China geopolitical tensions. Both have turned to discounting to try to maintain their appeal.

A shift away from Apple, in particular, has been sharp, spurred on by a top-down campaign to reduce iPhone usage among state employees and the triumphant return of Chinese national champion Huawei, which last year overcame US sanctions to roll out a homegrown smartphone capable of near 5G speeds.

Apple’s troubles were on full display at China’s annual Communist Party bash in Beijing this month, where a dozen participants told the Financial Times they were using phones from Chinese brands.

“For people coming here, they encourage us to use domestic phones, because phones like Apple are not safe,” said Zhan Wenlong, a nuclear physicist and party delegate. “[Apple phones] are made in China, but we don’t know if the chips have back doors.”

Wang Chunru, a member of China’s top political advisory body, the Chinese People’s Political Consultative Conference, said he was using a Huawei device. “We all know Apple has eavesdropping capabilities,” he said.

Delegate Li Yanfeng from Guangxi said her phone was manufactured by Huawei. “I trust domestic brands, using them was a uniform request.”

Financial Times using Bloomberg data

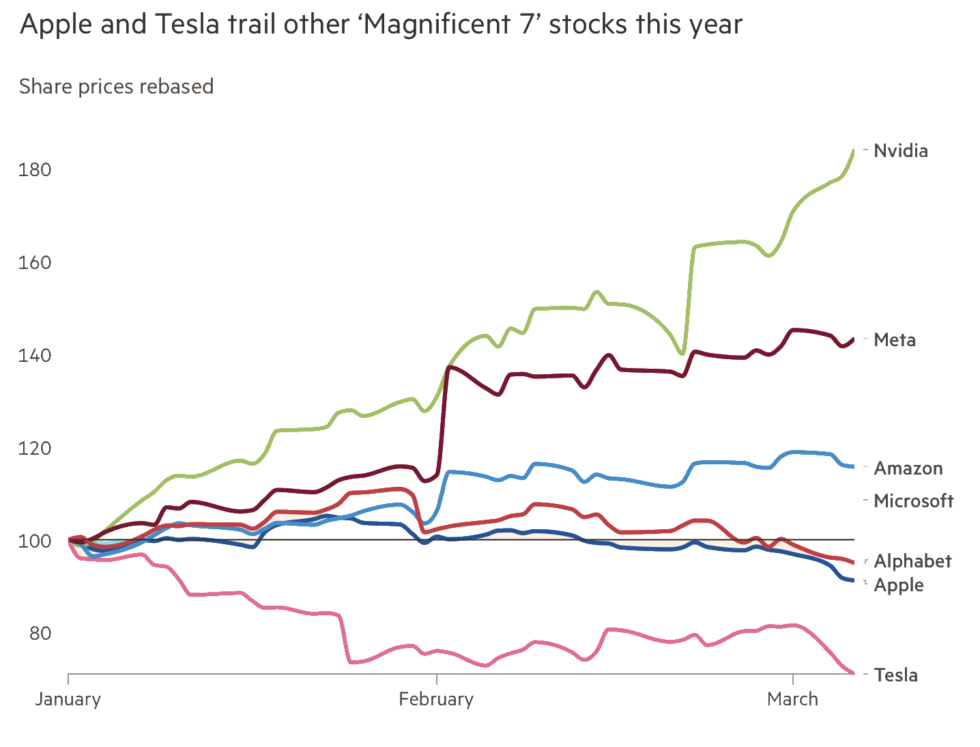

Outside of the US, China is both Apple and Tesla’s single-largest market, respectively contributing 19 percent and 22 percent of total revenues during their most recent fiscal years. Their mounting challenges in the country have caught Wall Street’s attention, contributing to Apple’s 9 percent share price slide this year and Tesla’s 28 percent fall, making them the poorest performers among the so-called Magnificent Seven tech stocks.

Apple and Tesla are the latest foreign companies to feel the pain of China’s shift toward local brands. Sales of Nike and Adidas clothing have yet to return to their 2021 peak. A recent McKinsey report showed a growing preference among Chinese consumers for local brands.