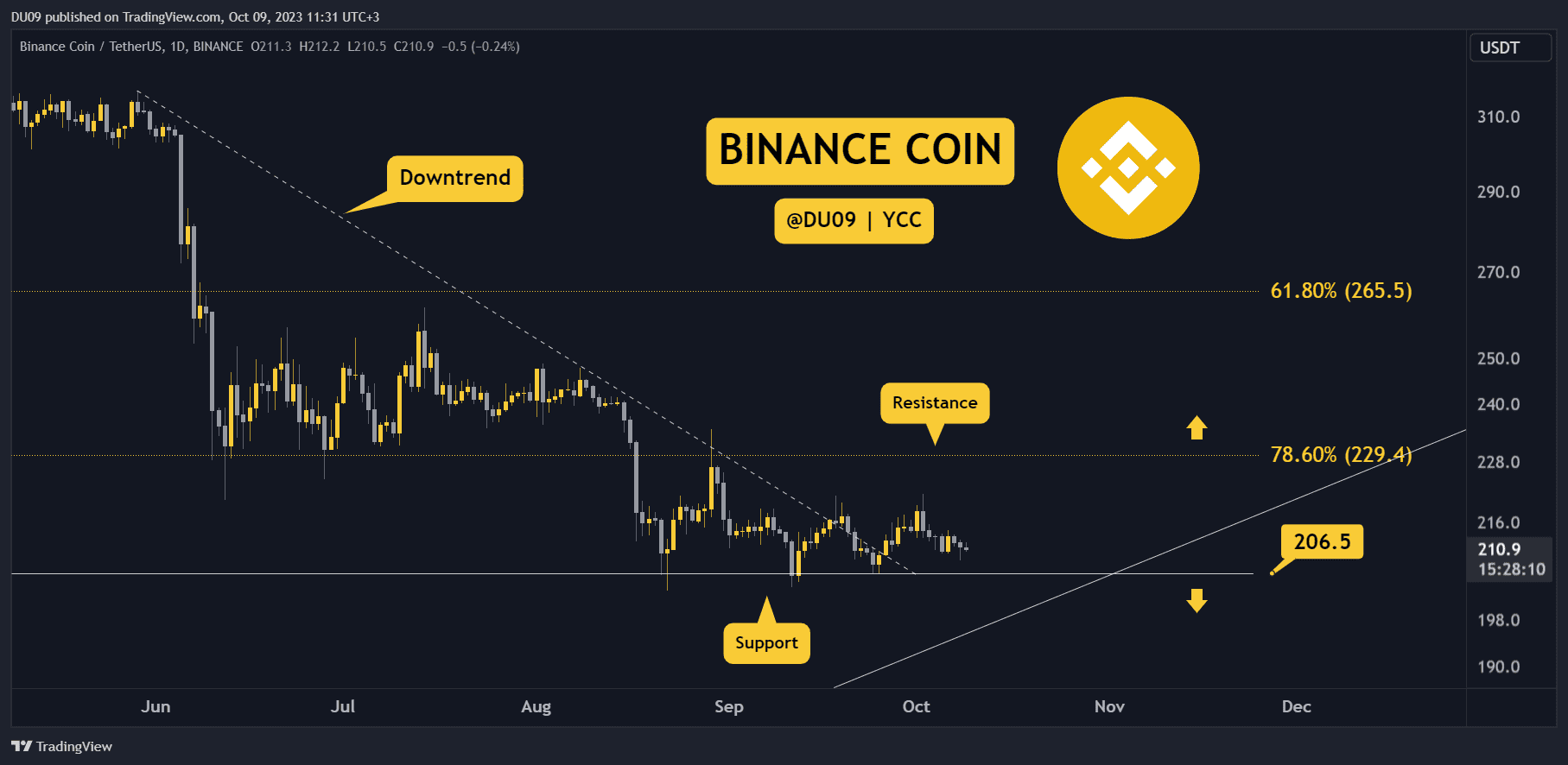

With buyers absent, BNB is struggling to hold above $200.

Key Support levels: $206, $180

Key Resistance levels: $220, $230

1. Indecision Continues

Binance Coin has not managed to move away from its key support just above $200. This is not ideal, as any new sell pressure could quickly test or even break this level. The price action also shows that sellers are having the upper hand right now.

2. Indicators Lean Bearish

The volume and momentum indicators show weakness and are bearish on the daily timeframe. Generally speaking, volume was always higher on the sell side and this is reflected both on the RSI and OBV which remain low.

3. MACD Bearish Cross

The daily MACD just did a bearish cross, further confirming that sellers appear to dominate at this time. If buyers don’t return, then the key support at $206 is in danger.

Bias

The bias for BNB is bearish.

Short-Term Prediction for BNB Price

Prepare for another test of the key support at $206. If that breaks, then BNB’s price will likely move towards $180 next.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.