Ethereum co-founder Vitalik Buterin saw his cryptocurrency holdings surge in value by over $57 million in a single day, according to data gathered from blockchain analytics platform Arkham Intelligence.

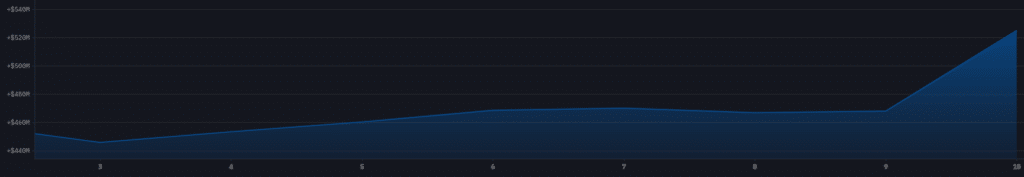

The platform reported that the assets held in Buterin’s publicly known addresses grew from $468 million on November 9 to $525 million on November 10, an increase of over 12% in 24 hours.

Of Buterin’s $525 million in holdings, $518 million is in Ethereum (ETH). This means the one-day growth is almost entirely attributed to the appreciation of ETH.

This Ethereum rally was presumably fueled by major ETF news from asset management giant BlackRock. On Nov. 9, filings revealed BlackRock is laying the groundwork for a potential spot Ethereum ETF.

The filings, posted on the Delaware Department of State’s website, indicate BlackRock is considering proposing an Ethereum ETF to the U.S. Securities and Exchange Commission (SEC). This would allow investors to trade an ETF that directly holds Ether.

BlackRock, which oversees $9 trillion in assets, already filed for a spot Bitcoin ETF in June. The timing of this latest Ethereum filing coincides with Ether reaching around $2,030, up over 8% in 24 hours.

Other major financial firms like Ark Invest, 21Shares, VanEck and Grayscale have been seeking approval for similar Ethereum ETF products. But BlackRock’s massive size means an ETF from the asset manager could bring significant new institutional investment.