It’s portfolio update time. It’s been a couple of months. But honestly, the market wasn’t doing very much for us to report on either. Now some things are moving.

So, we are taking a long look at our 50X Master Portfolio and we are making a couple of important changes. Come on in and see what we are up to!

Current & Historical Performance

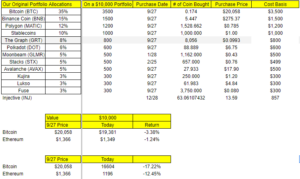

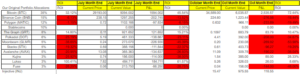

Bitcoin may or may not be in a bull market. It’s doing well. The rest of the market? Very uneven. From July, our last major update on this portfolio, Bitcoin is up about 15%. Ethereum is down almost 10% at the same time.

Bitcoin is powering the portfolio right now. It is by far the most profitable position both by % and by $$. The rest of our portfolio is still down. But thanks to Bitcoin, our total return is 13.12%. The 2 bellwethers, Bitcoin and Ethereum, are:

- Up 72%.

- Up 30% respectively.

So the good news is we are up and in the money. Many alt portfolios are not. But we are trailing both BTC and ETH in ROI right now.

In Profit

The profitable holdings right now besides Bitcoin are:

- The Graph.

- Kujira.

- Lukso.

Lukso has been a great performer for us. The Graph and Kujira have made some monster comebacks in recent months to go from losses to profit. After Bitcoin, the highest profit by % is Kujira at 28%.

In Losses

This means everything else is at a loss. And sadly, everything is at a double-digit loss of 10% or more. Our top 3 losses right now are:

- Moonbeam down 53%

- Avalanche is down 38%

- Polkadot down 34%

That’s a pretty rough performance right there. Moonbeam we are still satisfied with the project’s development and where they are at this stage so we are keeping it. But we do have a move coming up. We will be adjusting the portfolio this month.

Future Portfolio Direction

We are making one big move. We are selling a couple of our slow movers. We still like these projects but we think they could be slower to recover than other projects. So, we are selling:

- DOT.

- AVAX.

- Fuse.

Our cash proceeds from the sales are:

- $392 from DOT (a $208 loss)

- $309 from AVAX (a $190 loss)

- And $156 from FUSE (a $144 loss)

So our total losses are -$542 with proceeds of $857. Now here is what we are considering for the direction of the portfolio. It’s all based on what you think the direction of the market will be.

Scenario #1 Bull Trap/Not in a Bull Market Yet

So option 1 is if you think this is a relief rally and not the start of a new bull market. There are reasons to think this. For example:

- Only 54 coins are up over the last 7 days.

- Bitcoin is doing well, but many alts are not.

- We are def NOT in an Alt Season yet.

- Lots of economic uncertainty and political uncertainty in the US and China.

So if you think this is a relief rally and not the beginning of a big bull market, then the best way to handle this $857 is to buy stablecoins and hold onto them. For now.

Scenario #2 Start of a Bull Market

On the other hand, we could be seeing the start of a bull market. Those of you who follow quant analyst Plan B and his Stock to Flow model know that the 2-year upcycle that starts 6 months before the halving just started last week.

For those who don’t follow. In the last few 4 year cycles, there has been an upcycle and a down cycle each lasting ~2 years. The 4 years corresponds with each Bitcoin halving. The next will be in late April, 6 months from now.

The 2-year up cycle starts 6 months before the halving (meaning now) and goes until 18 months after. It’s held the last couple of cycles. Could it hold again? No one knows. But many people are playing the percentages that it could and they are buying or looking to buy now to HODL.

If you believe we have entered a new bull market then it makes sense to buy something here. If you are right, the probability is that you will make money. So it’s a question of do we think we can find a better opportunity for our $857 than in the 3 holdings we just sold.

What do you think? What would you add to our portfolio here? Let us know in the comments below.

New Buy

Our thesis is that we have just barely started into a new bull market. First, liquidity will go to Bitcoin (as it is doing). Then it will move to alts with maybe a full-on alt season. So with that in mind, here is what we are buying: INJECTIVE.

1/ Today, #InjectiveTurns2

2 years ago, the @Injective_ Mainnet was released and the world was introduced to the fastest L1 built for finance.

A

on some of the incredible accomplishments of the Injective ecosystem and community.https://t.co/3J67w68p9V

— Injective

(@Injective_) November 8, 2023

As a Cosmos-based appchain, Injective has a few things we are looking for:

- Namely.

- Interoperability.

- Appchain for financial apps/use.

- Good tokenomics. 83% of the maximum supply is the current circulating supply.

On October 28TH, we used our $857 to buy 63 $INJ at $13.59. It’s currently in a small profit of $115. We also like that Injective has grown during these tough market conditions. INJ is up 500% in the last year and 100% in the last 30 days.

It’s natural to wonder if that growth can continue. But we think the risk of slower growth is low given how much it’s grown during this long bear market. So DOT, AVAX, and FUSE are out. And INJ is in.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.

The post MAJOR 50X Crypto Portfolio Update – It’s Now Bullrun READY!! appeared first on Altcoin Buzz.