New Delhi: The Congress-led United Progressive Alliance (UPA) government inherited a healthy economy in 2004 but reduced it to a state of “non-performance” in its 10 years, the Modi government said in a white paper tabled Thursday in Parliament.

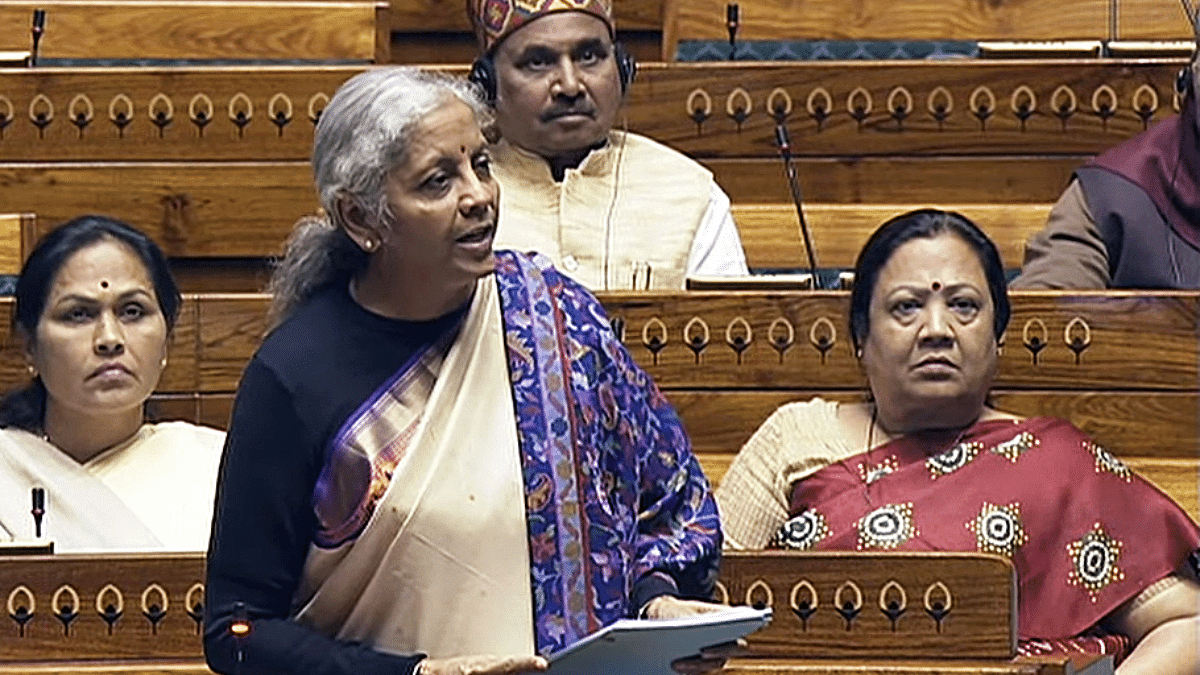

The white paper, which had been announced by Finance Minister Nirmala Sitharaman during her interim budget 2024 speech on 1 February, attacked the UPA government on a number of counts, including double-digit inflation, high levels of bad debt in the banking system, raising India’s vulnerability to external shocks, and a mismanagement of public funds characterised by numerous scams.

In her budget speech, Sitharaman had said the government would be tabling a white paper on the Indian economy as “it is now appropriate to look at where we were then till 2014 and where we are now, only for the purpose of drawing lessons from the mismanagement of those years”.

Overall, the white paper is divided into three parts. Part 1 deals with the economic and financial management under the UPA rule from 2004 to 2014. Part 2 records the “current status of the various corruption scams of the UPA government”, while Part 3 is about the economic and financial management and governance record of the Modi government since 2014.

Notably, the Modi government acknowledges that “states are equal partners in development” and that’s why it accepted the recommendations of the 14th and 15th Finance Commissions on the proportion of taxes it must share with states.

This statement comes at a time when multiple states are vociferously protesting against the Centre’s tax devolution policies. Ministers from Karnataka and Kerala have travelled to Delhi to protest over the course of Wednesday and Thursday. Over the last six months or so, the governments of Telangana and Tamil Nadu have also lent their voices to the protests against the Centre over this issue.

The paper further says the Goods and Services Tax (GST), introduced in 2017, was based on political consensus-building and pooled sovereignty. Again, these statements come at a time when many states are alleging that the GST introduction has impeded their ability to independently raise revenues, thereby increasing their dependence on the Centre.

Sitharaman, however, on Wednesday had refuted the claims made by the non-BJP states on the Centre’s devolution practices, saying that it has transferred whatever was recommended by the Finance Commission, and that no violation has taken place.

“Whatever was recommended by the finance commission has been given and will be given,” she said in a press conference. “Devolution, as recommended by the Finance Commission, is followed by us. There is no way that any violation has happened. I have followed it to the last word.”

‘States are equal partners in development’

“Acknowledging that States are equal partners in development, our government, in the true spirit of cooperative federalism, accepted the recommendations of the 14th and 15th Finance Commission,” the white paper says.

“Around 41-42 percent of Central taxes have been shared with the States every year over the last decade,” it adds. “This is a substantial jump from the earlier devolution share of 30-32 percent.”

As a result, the paper says, the quantum of resources transferred to the states is about 3.8 times “higher than earlier”. The data presented in the paper shows that the absolute amount devolved to states increased from Rs 22.1 lakh crore over 2004-14 to Rs 84.3 lakh crore over the 2014-15 financial year and the revised estimates for 2023-24.

As a percentage of GDP, the amount devolved to states during the UPA stood at 3.36 percent, which rose to 4.24 percent under the Modi government.

While the government claims that 41-42 percent of central taxes are being shared with the states, some of them allege that the actual amount is much lower.

For example, last June, Telangana finance minister T. Harish Rao said that despite the 15th Finance Commission recommending that 41 percent of central taxes be devolved to states, the actual amount was only about 30 percent since the Centre was relying more on cesses and surcharges, which do not need to be shared with states.

In her press conference Wednesday, Sitharaman said that it was a “myth” that some states were receiving preferential treatment over others with regard to devolution. “It’s a myth that one state is receiving less and the other is receiving more,” she asserted. “I have no role to play in that. It is a number determined by the Finance Commission, which is for tax devolution.”

‘GST characterised by political consensus’

The white paper touches upon another issue that is currently a matter of some rancour between the Centre and the states — the GST. The introduction of the GST regime was a “much-needed structural reform”, it says.

Before GST, it adds, the various differing state levies, more than 440 tax rates, excise duties and the compliance requirements of multiple agencies administering these rates meant that India’s internal trade was neither free nor united.

“The new tax structure is characterised by political consensus building and pooled sovereignty of the GST Council, both salient examples of cooperative federalism,” the paper says. “In order to protect the revenue interests of the States, during the initial years of GST, our government guaranteed compensation for states for 5 years (2017 – 2022) for any revenue shortfall from a minimum growth of 14 percent in GST revenues.”

The withdrawal of this compensation has been a matter of some discord among states, which say that GST revenue has not been as high as the Centre promised and seek the compensation for another five years.

In fact, a 2023 paper published by the National Institute of Public Finance and Policy (NIPFP) found that not only was the GST compensation essential, but that it continues to be necessary for states.

“Though GST compensation helped states to moderate the revenue shortfall in GST collection during 2019-20 to 2020-21, it could not wipe out the entire revenue shortfall in the GST collection for some states,” the NIPFP paper says. “Therefore, GST compensation was necessary for states to sustain the revenue stream which has subsumed into GST.”

In the white paper, the Centre adds that it has stood with the states in times of change.

“Acknowledging the need for timely funds in the States, we have front-loaded these payments to the States,” it says. “GST compensation cess, additional borrowings and very long-term interest-free loans for capital expenditure have expanded the resources of the States for spending as per their development and welfare needs.”

Also Read: Fresh jolt for INDIA bloc as AAP names 3 Assam candidates amid impasse with Congress — ‘We’re tired’

‘UPA inherited healthy economy, made it non-performing’

The first section of the paper extensively details how the UPA allegedly turned a healthy economy into a non-performing one over the course of its 10 years in power.

The issues it highlights include how the UPA’s attempt to maintain high economic growth “by any means” after the global financial crisis of 2008 actually “severely undermined” the economic foundations of the country.

The other issues include double-digit inflation, an ailing banking sector following excessive lending during the boom phase, and high policy uncertainty that “marred India’s business climate, dented its image and the people’s confidence about their future”.

“There were numerous scams bringing colossal revenue losses for the exchequer and fiscal and revenue deficits spiralling out of control,” the paper says. “In 2014, our government inherited a deeply damaged economy whose foundations had to be rebuilt to enable self-sustaining long-term economic growth.”

‘Rescue from a state of crisis, despair & paralysis’

The white paper says that when the Modi government came to power, the economy was “on a road to nowhere”, exhibiting signs of deep distress emanating from multiple ‘wrong turns’ in economic policy.

“The disconnect between India’s policy planners and priorities for the country was so stark that the people gave an overwhelming mandate in the General Elections of 2014 to the National Democratic Alliance (NDA) to take charge of the reins, reverse the staggering economic and fiscal muddle that the country was mired in and restore its dynamism and optimism,” it states.

Thereafter, the paper enumerates the number of ways the Modi government “revamped and overhauled systems and processes to help India advance on the path of development while also bolstering its macroeconomic foundations”.

“Right from spearheading the digital revolution to elimination of open defecation, and from successfully vaccinating the entire eligible population using indigenous vaccines to substantially diversifying exports, India has achieved remarkable milestones under our new governance paradigm,” it says.

It adds that the Modi government has gotten rid of a number of inefficiencies through the simplification and rationalisation of a number of laws, “adopting a trust-based and responsive delivery machinery”, implementing ease of doing business reforms, bringing in inclusive scheme designs focused on “partnerships with the citizens and also with the States through strengthened cooperative federalism”.

“Contrary to the piecemeal delivery of the past, we have achieved saturation coverage for all deserving beneficiaries,” the paper says. “We shifted the welfare focus from entitlement-based support to empowering individuals by integrating them into the formal sector.”

(Edited by Tony Rai)

Also Read: Modi praises Manmohan Singh, calls him ‘inspirational’ ahead of tabling white paper on economy under UPA