NFTs and DeFi are starting to work together. More and more Dapps in the DeFi space have started to use NFTs in their products. For example, RWA tokenizes real-world assets.

These tokens are NFTs. But we see more use cases for NFTs in the DeFi space. So, that’s why we are taking a closer look at NFT-Fi.

1/

Introducing the Thriving NFT-Fi Landscape V2

NFT-Fi is a blazing frontier where DeFi meets NFTs

@chrischang43 and I are back again for a comprehensive look at Ethereum's NFT-Fi protocols in our Ultimate NFT-Fi Landscape V2.

Let's dive in!

pic.twitter.com/L3h27CQicd

— Tytan.ETH (@Tytaninc) August 3, 2023

What Is NFT-Fi?

NFT-Fi stands for NFT Finance or Financialization. In other words, you use NFTs to increase markets, financial institutions, etc., in size and influence. Besides this, DeFi offers another interesting feature. It can explore areas that TradFi doesn’t cover. That, right there, is where it becomes fascinating.

So, rather than replacing TradFi, DeFi can also complement it. Where TradFi is mostly centralized, DeFi offers a decentralized alternative. Throw NFTs into this equation, and we have NFT-Fi. As a result, instead of selling your NFTs, you can now, for example:

- Borrow or lend them.

- Fractionalize your NFTs.

- Rent them out.

Three key benefits of NFT-Fi are:

- Increased liquidity – with new use cases for NFTs, you increase their liquidity.

- Expanded financial utility – you can create more sophisticated markets around NFTs.

- Better risk mitigation. – you can create a wider exposure to entire markets, instead of only one segment.

So, let’s take a closer look at how we can use NFT-Fi tools.

Source: Chainlink blog

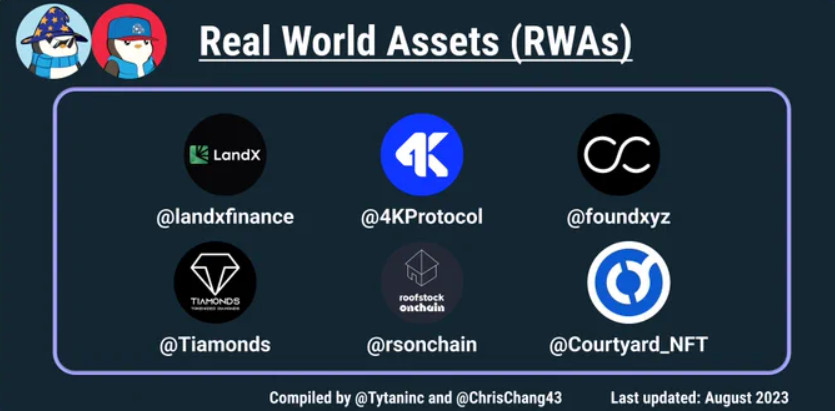

RWAs or Real-World Assets

RWA projects tokenize real-world assets. There’s a wide variety of RWA projects around. They all target different RWAs. For example,

- Landx.fi – They offer sustainable yield through regenerative agriculture.

- 4k Protocol – Bringing physical assets on-chain.

- Found.xyz – Tokenizing bankruptcy claims which can unlock DeFi loans.

- Roofstock onChain – Buy and sell real estate on-chain.

RWAs can open up a multibillion-dollar market. Currently, RWAs are one of the hottest crypto spaces, ready to take off.

Source: Twitter/X

Lending Aggregators

Unlock NFT liquidity by lending them. Aggregators combine a variety of NFT marketplaces. This allows you to manage and compare offers. They open up new options. Projects active in this market segment, are, for example,

NFT Rentals

Rent out your NFTs and join the sharing economy. Renting allows you to earn with an extra revenue model. Borrowing gives you the opportunity to have temporary funds. Active in this space are, for instance:

Unlock the full potential of your game with NFT rentals!

@Nickev123 tells you all the deets.

Learn more

https://t.co/UMXVwFcKbO pic.twitter.com/QffGDxHmRk

— reNFT – Rent & Lend NFTs (@renftlabs) May 4, 2023

Liquidity Scaling

With these projects, you can earn real yield from automated NFT-backed lending strategies. Real yield is an up-and-coming yield-earning metric. So, you need to focus here on ‘real’. In other words, yield is not based on manipulation or unsustainable token emissions. Active in this field are, among others,

Valuations

Enhance your collector cravings with data-driven knowledge. Find machine-driven NFT pricing or in-depth insights into NFT markets. Explore the lesser traveled road in DeFi options. Here are some players, active in this market segment. For example,

The NFT market has become its own complex financial system.

But NFT evaluation methods haven't kept pace with the market's evolution.

+Floor prices

+Manual assessments

+And collection-wide assessmentsAll miss the mark.

We need more nuanced AI-powered valuation. Here's how

pic.twitter.com/vL1yS6UdDq

— Upshot (@UpshotHQ) August 10, 2023

NFT Marketplaces

NFT marketplaces allow you to buy, sell and trade NFTs effortlessly. All chains that offer NFTs have also their own NFT marketplace(s). Here are some options, for instance,

- OpenSea on Ethereum, Polygon, Klaytn, Solana, Arbitrum, and Optimism.

- Blur on Ethereum.

- Magic Eden on Solana, Polygon, Ethereum, and Bitcoin.

- BlueMove or Souffl3 on Aptos and Sui.

- Stargate on Cosmos.

ME TV Presents:

Creator Confessions with @Uzy1000x of @mobstudios_

We sat down with @Uzy1000x for his first ever DOXXED INTERVIEW!

Dive into Mob Studios and learn how they’re building for the long term, giving back to their community, and innovating

pic.twitter.com/yl60iWoI84

— Magic Eden

(@MagicEden) August 21, 2023

Derivatives/Options

Manage or hedge your NFT risks with derivatives, perpetuals, or options. So, did you know that there are NFT DEXs or option protocols? For instance,

However, be careful when using leverage. It offers great gains, but your losses can also be extensive.

1/ Introducing Liquidity Aggregation

The NFT market is fragmented and inefficient, which hinders the market’s ability to grow.

With liquidity aggregation on our backend, we seamlessly match buyers with liquidity across NFT-Fi protocols to create a more efficient NFT market. pic.twitter.com/X672IHZPxi

— Wasabi Protocol

(@wasabi_protocol) August 9, 2023

Fractional Liquidity

Fractional NFTs are an excellent option for sharing your exposure and reducing risks. You can democratize NFT ownership and liquidity. Fractionalize your NFT and increase its liquidity. Or how about on-chain index tokens, like ETFs? Active in this field, are among others,

Ether Futures ETFs: What You Must Know Now!

— nealthy (@nealthy_xyz) August 21, 2023

Conclusion

NFT-Fi is an exciting space. It combines NFTs with DeFi. Tokenization is key and it represents many fields. From RWA via NFT marketplaces to NFT rentals or fractionalizing your NFTs and more. Tokenization of real-world assets can bring a multi-billion market into this playing field. Diversify your NFT options. So you can get better liquidity options with a wide variety of solutions.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.

Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.

The post NFT-Fi, the Connection Between NFTs and DeFi appeared first on Altcoin Buzz.