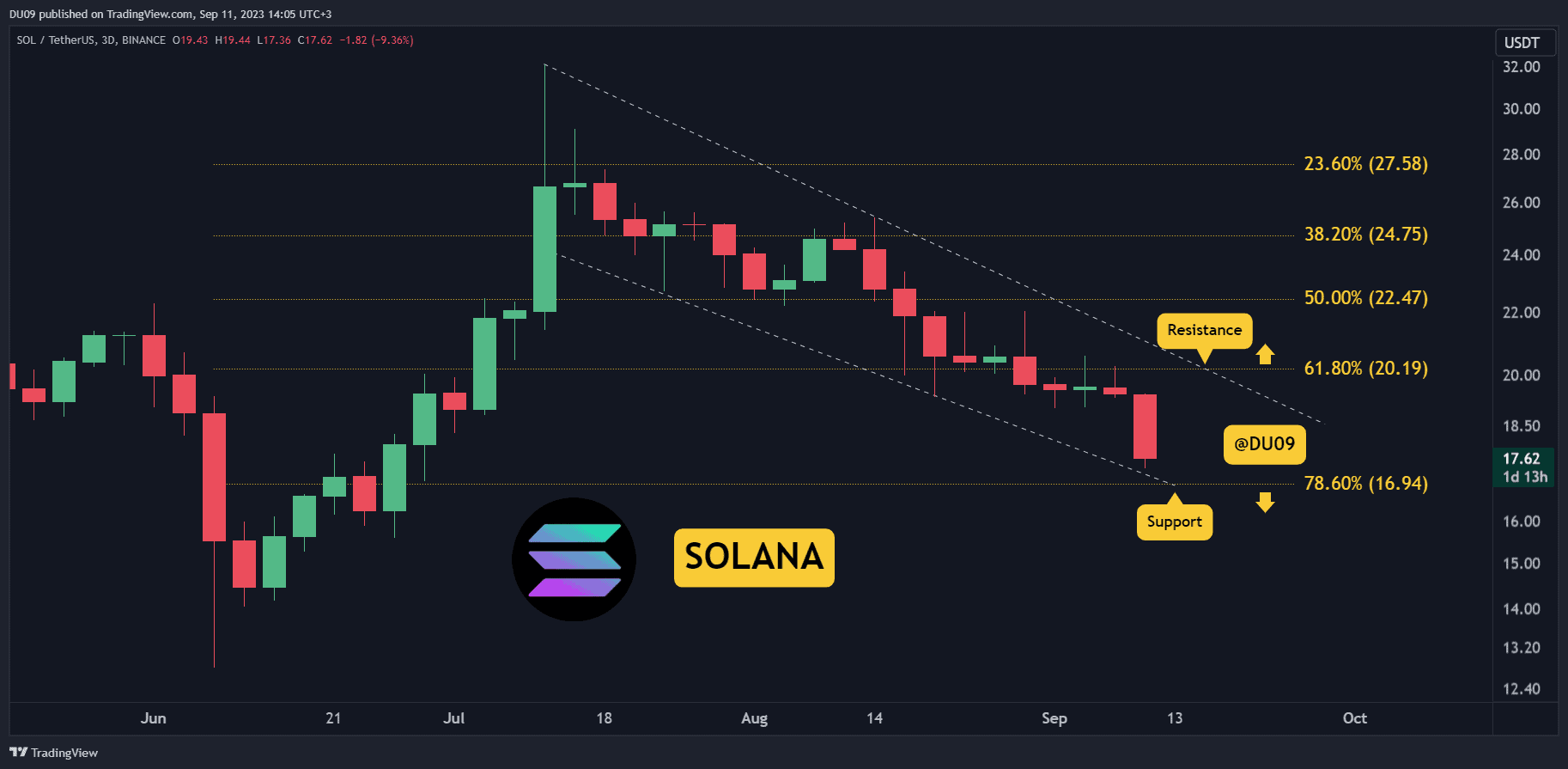

SOL’s price nosedived in the past two days as the selling pressure intensified.

Key Support levels: $17

Key Resistance levels: $20

1. SOL Crashes on FTX News

SOL’s price crashed after the news broke out that FTX would aim to liquidate its SOL position. Even if some of those coins are vested and cannot be sold, the news spooked the market. Traders holding a position on Solana were quick to liquidate, and this was reflected in the price that registered a 10% loss compared to last week.

2. Bearish Momentum Intensifies

With sellers having full control of the price action, the best hope for Solana is to hold at the $17 support level, which is the most important level at this time. Should that not manage to stop this downtrend, then the price will be more likely revisit $15 next. Such levels were last seen in June.

3. Lower Lows on MACD

The 3-day MACD histogram has made a lower low. This is bad news for Solana because it shows that sellers may continue to put pressure on the price and take it lower in the future. The daily RSI may also reach the oversold area if this continues which could trigger a bounce on the $17 level.

Bias

The bias for SOL is bearish.

Short-Term Prediction for SOL Price

Expect the price to continue down and test the key support at $17. Should that hold, then bulls may have a chance to reverse this downtrend. For now, the market sentiment is bearish, and the FTX news may continue to scare buyers away from SOL.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.