The collapse of FTX and its associated entity, Alameda Research, delivered a substantial blow to Solana’s ecosystem.

Alameda, a prominent early participant in Solana, held a considerable amount of Solana’s native SOL token. And other tokens from small-cap ecosystem projects. These included $MAPS from the mapping application Maps.me, $OXY from decentralized prime brokerage Oxygen Protocol, $FIDA from decentralized exchange Bonfida, and $SRM from Serum. In this article, we’ll discover more about Solana’s Status after FTX’s Collapse.

Analyzing Solana After the FTX Collapse

Post-FTX collapse, all these tokens witnessed a significant devaluation, ranging between 50% and 99%, with none reclaiming its pre-FTX valuation.

Source: Kaiko

Despite the adverse effects on its ecosystem, Solana’s native SOL token has demonstrated an impressive recovery throughout the year, notably surpassing $ETH in risk-adjusted terms.

1) Liquidity Challenges for Smaller Tokens

Beyond the price downturn, liquidity for the smaller ecosystem tokens has also suffered a severe setback, lingering between 50% and 80% below the levels observed before the FTX collapse.

$OXY and $MAPS, particularly impacted as over 90% of their token supply was held on FTX, experienced the harshest consequences. $MAPS, in particular, saw its liquidity practically vanish from centralized exchanges. It trades on only a handful of DEXs with scarce liquidity.

Source: Kaiko

Binance continues to dominate as the primary source of liquidity for these tokens, with Kraken emerging as the second-largest market in recent months.

2) Dynamics of SOL

Despite its notable price surge this year, $SOL’s 1% market depth has decreased from $34 million a year ago to approximately $16 million.

Moreover, it’s worth highlighting that in Q3, $SOL’s market depth, both in native units (considering price impact) and USD terms, exhibited an uptick. It suggests heightened interest and increased participation from market makers. Potentially influenced by partnerships with VISA and other positive news events.

Source: Kaiko

The rapid rebound of $SOL underscores the significance of fundamentals, particularly in the post-FTX landscape. Where investors display increased selectivity and risk aversion.

However, it is essential to note that $SOL experienced a dip coinciding with the commencement of the criminal trial of Sam Bankman-Fried, the former CEO of the crypto brand. The frequent mentions of $SOL in the trial proceedings might contribute, at least in part, to the observed dip in its value.

If you’d like to access more info about these kinds of research and more, you can subscribe to Altcoin Buzz Alpha.

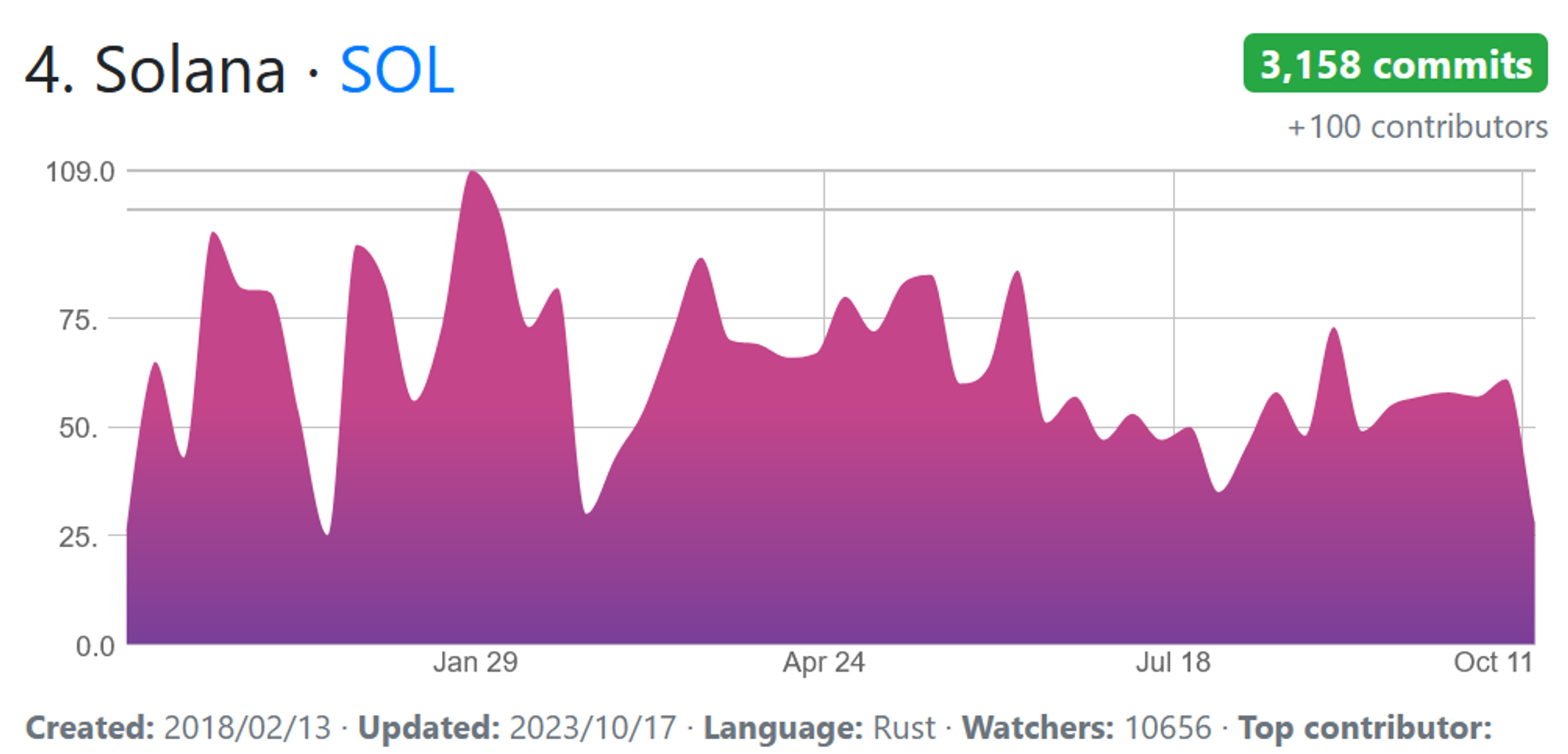

3) Development Activity

On a yearly basis, Solana ranks 4 in development activity, below Internet Computer, Sushi, and Mina protocol. 400+ community developers contribute to the project, compared to Polkadot (250 community developers).

In a micro view, Solana ranks 6 in developer activity.

Conclusion

Solana is fundamentally strong- Also, development activity is pretty high, and liquidity for ecosystem tokens is improving. The NFT craze has left the Solana chain, and now it is positioning as a faster, cheaper L1 alternative.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted risk tolerance levels of the writer/reviewers, and their risk tolerance may differ from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post The State Of Solana Post FTX Collapse appeared first on Altcoin Buzz.