In the last bull run of 2021, DeFi coins took center stage. Many of these DeFi tokens gave investors the best gains of the year. Indeed, many lending coins like $AAVE and $MKR rose to blue chip status then.

Fast forward to today, we need to be preparing for the next bull run. Sticking to the lending narrative, we look at the top 5 lending coins to accumulate below.

Coin #1 – $COMP

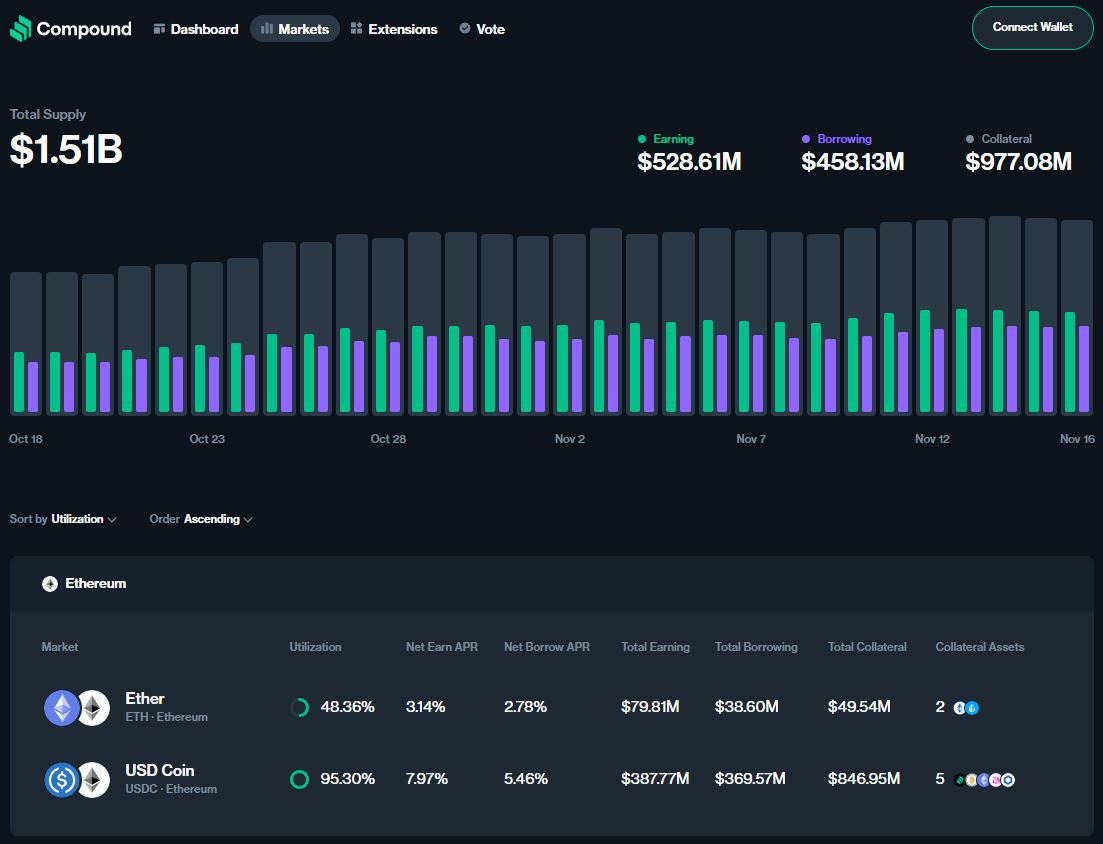

First of the lending coins we’re looking at is $COMP. It’s the protocol token for Compound Finance, a lending project on Ethereum. On Compound, you’re able to deposit your crypto as collateral. You’ll then become a lender of your crypto. From that, you’ll earn a yearly return on your assets.

Aside from that, you can borrow crypto from the platform too! By doing so, you won’t have to sell your main crypto holdings for spending. Instead, just take a loan from your deposited collateral. Then, you can take your time to pay back said loan.

Currently, $COMP has a price of $51.58, and a market cap of $353 million. It’s the largest market cap coin in today’s list. The project has a Total Value Locked (TVL) of $1.16 billion.

Coin #2 – $JST

Number 2 of our 5 lending coins is $JST. $JST is the native coin for JUST, a DeFi project on the Tron blockchain. JUST has many products, but its main one is JustLend. It’s a lending and borrowing protocol that’s pretty similar to Compound.

6/ The $JST token is now the 2rd largest TVL ($5.911B) among all Lending projects.

➮ Market Cap: $298.84M

➮ FDV: $334.34M

➮ Max ATH: $0.1975 pic.twitter.com/Qh2kPWpIaG— Joker

(@0xJok9r) November 14, 2023

As of time of writing, JustLend has a staggering TVL of $5.9 billion. This makes it the top TVL project in our list of lending coins. So, if you’re bullish on the Tron ecosystem, you can’t miss out on $JST.

$JST has a price of $0.033 and a market cap of $293 million. With this, it ranks #147 in the market cap ranking. Now, let us segue into the next coin.

Coin #3 – $RDNT

Next on our list of lending coins is $RDNT. This is the native coin for Radiant Capital. In a nutshell, Radiant is a Decentralized Application (dApp) aiming to unify liquidity. As of now, it’s live on Arbitrum, BNB Chain and Ethereum.

7/ @RDNTCapital ($RDNT)

Radiant Capital is a fully-decentralized community-governed protocol that aims to unify fragmented liquidity across Web3 money markets.

➮ fully decentralized and community-governed protocol.

➮ Offer industry-leading compensation to liquidity providers. pic.twitter.com/hCLr6v0zdc— Joker

(@0xJok9r) November 14, 2023

Radiant is a unique lending protocol. By providing collateral in one chain, you’re able to take loans in another. This feature adds on more utility compared to Compound and JustLend. With this, Radiant is able to accrue a current TVL of $346 million.

$RDNT has a price of $0.25 and a market cap of $92.7 million. With this, it ranks #321 in the market cap ranking. Time for us to dive into the next coin.

Coin #4 – $SILO

Moving on, we look at $SILO. $SILO is the token for Silo Finance, a non-custodial lending protocol. It sets itself apart from other lending protocols with better security. To do this, its money markets are divided into Silos. This makes each Silo independent of each other.

So, when there’s an exploit or hack, only 1 Silo will be affected. For instance, if you participate in the $BTC Silo and the $ETH Silo is hacked, your funds are safe.

If you are a $USDC holder, we are (unbiasedly) the best lending market to put your tokens to work.

We have:

Security

Yield

FlexibilityHere's how we accomplish this

pic.twitter.com/8TqxkK6Br6

— Silo Labs (@SiloFinance) November 14, 2023

Silo is active only on Ethereum and Arbitrum. Yet, it manages to build a strong TVL of $203 million. Now that’s pretty neat!

$SILO has a price of $0.068 and a market cap of $18.8 million. With this, it ranks #761 in the market cap ranking.

Coin #5 – $FXS

Lastly, we look at #5 from our list of lending coins, $FXS. This is the main token powering Frax Finance, along with the $FRAX stablecoin. It has a suite of products, which include:

- FraxSwap: A market maker and DEX.

- FraxFerry: A bridge for transferring $FRAX and related tokens across chains.

- FraxLend: A lending protocol for ERC-20 tokens.

3/ @fraxfinance ( $FXS ) is a complete DeFi ecosystem revolving around 3 of its stablecoins: $FRAX, $FPI, and $frxETH

Fraxswap (AMM Dex), Fraxlend (Lending market), Fraxferry (Transport/bridge)

Building a new L2, Fraxchain

Upcoming FrxETH v2 will change the #LSD game pic.twitter.com/s7UuBYNpjy

— WOO X (@_WOO_X) June 20, 2023

Frax Finance is only on Ethereum at the moment. It has amassed an admirable TVL of $831 million. $FXS has a price of $7.14 and a market cap of $536.1 million. With this, it ranks #90 in the market cap ranking.

Conclusion

That concludes the list of the top 5 lending coins for this bull run! All of the above 5 projects are active in the DeFi space. As a DeFi investor, you can either make money by trading the above coins. Or, you could just deposit your crypto in the platforms for a yearly yield. The choice is yours!

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Top 5 Lending Coins to Accumulate for the Bull Run appeared first on Altcoin Buzz.