US added 187,000 new jobs in July

Newsflash: The US economy added fewer new jobs than expected last month.

The US non-farm payroll rose by 187,000 in July, data just released shows, below forecasts of an increase of 200,000.

June’s NFP has been revised down too, from +209,000 to +185,000, while May’s has been cut by 25,000, from +306,000 to +281,000, meaning fewer jobs were created in the spring than we thought.

The U.S. Bureau of Labor Statistics has also reported that the unemployment rate fell to 3.5%, down from 3.6% in June.

They add:

Job gains occurred in health care, social assistance, financial activities, and wholesale trade.

Key events

Today’s jobs report indicates the Fed’s aggressive actions to combat inflation are beginning to soften what has been a strong jobs market, says Stephen J. Rich, Chairman & CEO of Mutual of America Capital Management.

Rich explains:

Today’s softer jobs report could be viewed as a harbinger of slower economic growth and the equity markets typically do not like such negative numbers. Until now, the strong labor market has been a key area of strength, unaffected by the Fed’s interest rate policy. However, if weak job growth continues and unemployment escalates, talk of a recession is likely to grow louder again and the equity markets will likely give back some of their gains.”

“Despite wider signs of a possible economic slowdown, we expect the unemployment rate to remain low in the coming months and serve as reassurance for the Fed as they continue with their efforts to bring inflation down to their 2.0% target rate.”

Today’s US jobs report is “slightly weaker than expected”, says Richard Flynn, managing director at Charles Schwab UK:

Last month’s results offered evidence that employment growth had begun to slow, and today’s numbers indicate that a downward trend may be in motion.

While this should be encouraging for policymakers as they continue to battle sticky inflation, the Fed would likely prefer to see wage gains closer to 3%.

Growth in the 4% region may not be enough to convince bankers that monetary policy is working, so further interest rate hikes may be around the corner.”

US hourly earnings higher than expected

Pay growth in July was faster than expected, in a boost for US workers.

The jobs report shows that average hourly earnings for all employees on private nonfarm payrolls rose by 14 cents, or 0.4%, month-on-month in July to $33.74. Economists had expected a rise of 0.3%.

On an annual basis, average hourly earnings have increased by 4.4%, beating forecasts of a slowdown to 4.2%.

That might cause the Fed some concerns, as its policymakers ponder whether they have raised US interest rates high enough to drive out inflation.

Non-Farm Payrolls – Improvement in jobless rate = underlying strength.

Good for Stocks, should be +USD but traders dont see this as enough for Sept hike👎 NFP +187K vs 200K Forecast

👍 Unemployment Rate 3.5% vs. 3.6% Forecast

👍 Average Hourly Earnings 0.4% vs. 0.3% Forecast— Kathy Lien (@kathylienfx) August 4, 2023

At 187,000, July’s jobs gains are rather less than the average monthly gain of 312,000 over the prior 12 months.

That indicates that the Federal Reserve’s policy of raising US interest rates to cool the economy is having an effect.

US added 187,000 new jobs in July

Newsflash: The US economy added fewer new jobs than expected last month.

The US non-farm payroll rose by 187,000 in July, data just released shows, below forecasts of an increase of 200,000.

June’s NFP has been revised down too, from +209,000 to +185,000, while May’s has been cut by 25,000, from +306,000 to +281,000, meaning fewer jobs were created in the spring than we thought.

The U.S. Bureau of Labor Statistics has also reported that the unemployment rate fell to 3.5%, down from 3.6% in June.

They add:

Job gains occurred in health care, social assistance, financial activities, and wholesale trade.

Forecasting the monthly non-farm payroll changes is a tricky task, and economists have a range of views.

Estimates range from a 140,000 increase, which would be quite disappointing, to a cheerier 300,000 new jobs, according to estimates on Refinitiv.

#NFP | PREVIEW: July US Nonfarm Payrolls Expected To Fall To 200,000; Unemployment Rate To Hold Steady At 3.6%

Take A Look At What The Top Economists Are Forecasting In Today’s US Jobs Report: pic.twitter.com/70QQ8m6aG9

— TradeSignals24 (@TradeSignals_24) August 4, 2023

We’re about to find out who’s right….

US July jobs report coming up….

The financial markets are eagerly awaiting the latest US jobs report, due on the half-hour.

July’s Non-Farm Payroll is expected to show that the US economy added around 200,00 new jobs last month, slightly down on the 209,000 new hires recorded in June.

June’s jobs gain was the weakest since December 2020.

Economists will also be watching the latest pay figures, for signs that higher interest rates are cooling the labor market.

Hourly earnings are expected to slow to 4.2% year-on-year from 4.4% previously but continue to rise month-on-month. The unemployment rate is also expected to remain at a long-term low of 3.6%.

Analysts at FxPro point out that eleven out of the last twelve labour market reports have exceeded expectations – with last month’s being a rare miss.

They add:

A second worse-than-expected report in a row could crystallise the market pressure and become the first signal of a trend reversal.

The wage rate is also important for the dollar’s momentum: a better-than-expected reading is a reason for the Fed to tighten policy, which is positive for the dollar. Weak wage growth and strong employment can revive the appeal of risky assets to the detriment of the US dollar.

Happy Jobs Day!

The July US labour market report is due this lunchtime, with consensus expecting NFP to rise +200k on the month, a marginal slowdown from the +209k seen in June pic.twitter.com/ZnCuIde97p

— Pepperstone (@PepperstoneFX) August 4, 2023

Bank of England chief economist, Huw Pill, is briefing the Bank’s agents about yesterday’s interest rate decision and monetary policy report:

BOE’S PILL: THERE ARE INCREASING SIGNS THAT OUR POLICY IS WORKING TO BRING DOWN INFLATION.

— Breaking Market News (@financialjuice) August 4, 2023

BOE’S PILL: RESTRICTIVE RATES WILL WEIGH ON ACTIVITY AND PRICES.

— Breaking Market News (@financialjuice) August 4, 2023

BOE’S PILL: IF THE MPC MAINTAINS RATES IN RESTRICTIVE TERRITORY, IT WILL CONTINUE TO WEIGH ON INFLATION.

— Breaking Market News (@financialjuice) August 4, 2023

BOE’S PILL: WE ARE TRYING TO BALANCE RISKS OF DOING TOO LITTLE BUT IT IS POSSIBLE THAT WE DO TOO MUCH.

— Breaking Market News (@financialjuice) August 4, 2023

BOE’S PILL: THE GREATER RISK IS THAT INFLATION WILL PERSIST IN THE UK.

— Breaking Market News (@financialjuice) August 4, 2023

We have had some encouraging economic data from Germany earlier today.

German factory orders unexpectedly jumped by 7% in June, the most in three years, which may show that Europe’s largest economy is stabilizing.

The surprise increase was down to a pick-up in major orders, such as machinery and aircraft.

Airbus, which has a major factory in Hamburg and smaller plants in other parts of Germany, reported a jump in aircraft orders in June.

Some encouraging Macro data coming from #Germany.

The volume, hence real factory #orders, rose by a whopping 7.0% in June.

As a result, order volume rose 3.0% from a year ago, marking the first year-on-year increase since February 2022.

These numbers do not match a #recession! pic.twitter.com/vcxLWlHbrG— jeroen blokland (@jsblokland) August 4, 2023

World stock markets are set for their worst week since March, unless the upcoming US jobs report in 45 minutes can provide a lift.

The MSCI All-World index is headed for its biggest weekly drop in five months, Reuters reports, thanks in part to a surge in government bond yields this week after more data pointed to slowing inflation and the prospect of a deluge of U.S. Treasury supply.

WPP also said that brands are taking a “wait and see” approach to advertising on social media platform X (the rebranded Twitter), until they can understand where owner Elon Musk is taking the company.

WPP CEO Mark Read said the re-branding “took people a little bit by surprise”.

He told Reuters:

“Clients cannot understand where the platform is heading and what its character will be in the future.

“Some clients are dipping their toe back in, but overall I’d describe it as wait and see.”

Advertising giant WPP has added to fears of an economic slowdown, by reporting today that major tech firms had cut their marketing spending.

WPP lowered its forecast for revenue growth this morning, with chief executive Mark Read explaining:

“Our performance in the first half has been resilient with Q2 growth accelerating in all regions except the USA, which was impacted in the second quarter by lower spending from technology clients and some delays in technology-related projects.

WPP now expects like-for-like revenue, less pass-through costs, growth of 1.5-3.0% for FY 2023, down from 3-5% previously.

After hitting a five-week low of $1.2620 yesterday, then rebounding, the pound is trading just below $1.27 this morning, broadly flat on the day.

Raffi Boyadjian, lead investment analyst at XM, says sterling is struggling to find its feet, as investors are disappointed that the Bank of England didn’t strike a more hawkish tone when it raised interest rates by a quarter-point yesterday.

Boyadjian says:

The pound tumbled yesterday after Governor Andrew Bailey told reporters he didn’t think there was a case for a 50-bps hike.

The downgrade in growth forecasts could also be weighing on sterling even though inflation is seen falling to 2% or below by 2025. But with upside risks to wage growth, investors remain sceptical about how quickly the BoE will be able to get inflation under control.

Over in the eurozone, policymakers are growing more confident that inflation has peaked.

The European Central Bank said today that underlying inflation in the euro zone has probably peaked, which could encourage the ECB to pause its cycle of interest rate rises.

In a new article published this morning, ECB economists say:

Median and mean underlying inflation measures suggest that underlying inflation likely peaked in the first half of 2023, particularly when looking through the upward base effect caused by the introduction of the €9 ticket in Germany in June 2022.

The article also warns there has been an “ongoing shift in inflationary forces from external to domestic sources”.

Joanna Partridge

In the City, shares in outsourcing group Capita have tumbled by over 14% after it reported a loss this morning, partly due to the costs of a cyber attack.

Capita reported a pre-tax loss of £67.9m for the first half of this year, down from a £100,000 profit in H1 2022. It said the loss was due to “business exits, non-core Portfolio goodwill impairment and costs associated with the Group’s cyber incident”.

That attack, Capita revealed this morning, will cost up to £25m.

The group is still recovering from the attack by the Black Basta ransomware group, which hacked its Microsoft Office 365 software and accessed the personal data of staff working for the company and dozens of clients.

Capita confirmed on Friday that “some data was exfiltrated” from its IT systems but added that this was less than 0.1% of its server estate. More here.

Maersk predicts prolonged container trade slowdown

In a blow to growth hopes, shipping giant AP Møller-Maersk has warned of a longer and deeper contraction of global trade than previously expected.

Maersk predicted this morning that global container volume growth will contract by between 1% and 4% this year. It had previously forecast volumes of between +0.5% and -2.5%.

It blames:

…muted global macro-economic growth given continued pressure from higher interest rates and potential recessionary risk in Europe and the US.

Maersk ships goods around the world, so is a handy barometer of global economic developments.

Chief executive Vincent Clerc said he saw no sign that the destocking which has curbed global trade activity would end this year.

Clerc told a media briefing:

“We had expected customers to draw down inventories around the middle of the year, but so far we see no signs of that happening. It may happen at the beginning of next year.”

“Consequently, the uptick in volumes we had expected in the second half of the year has not occurred.

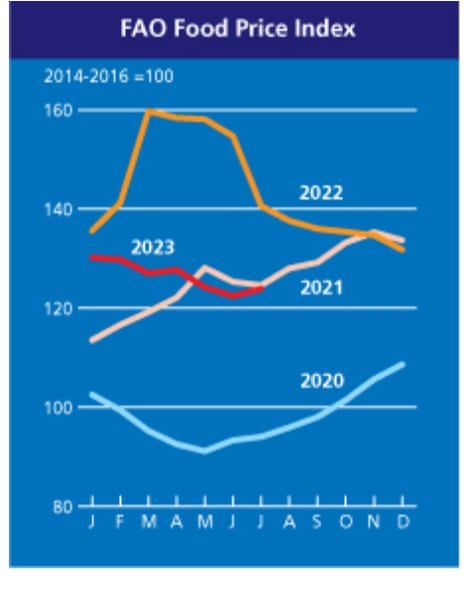

World food prices rise in July

Joanna Partridge

The price of essential ingredients is rising again around the world as the ongoing conflict in Ukraine, political events, and unpredictable weather are impacting crops and the transport of foodstuffs such as cereals.

The rice price index hit its highest level in almost 12 years in July, after rising 2.8% last month alone, according to the UN’s international food price index. The increase came after India banned exports of non-basmati white rice on 20 July, in a bid to curb domestic food inflation after heavy rains hit crops in the world’s largest exporting nation.

The UN’s Food and Agriculture Organization (FAO) said the move had amplified “upward pressure already exerted on prices by seasonally tighter supplies and Asian purchases.”

Rice prices have continued to climb on global commodity markets in recent days, with exporters reporting that Indian parboiled prices hitting a record high this week, as demand shifted to this grade, which is not subject to export restrictions.

Traders in Thailand and Vietnam, the world’s second and third largest rice exporting countries, have also been looking to re-negotiate prices of August rice shipments, Reuters reported earlier this week, to take advantage of rising prices.

The cost of wheat also made their first monthly climb in nine months in July, the UN FAO found, because of uncertainty about Ukrainian grain exports since Russia decided to terminate the Black Sea grain deal last month, which had guaranteed safe shipment from Ukraine’s sea ports. Russia’s subsequent attacks on Ukrainian port infrastructure on the Black Sea and Danube river pushed international wheat prices up by 1.6% last month according to the UN food price index.

The price of vegetable oils soared by 12% last month compared with June, marking the first increase after seven months of falls, as international prices of sunflower, palm, soy and rapeseed oils all rose. Sunflower oil prices surged by 15% month-on-month over worries about exporting the product out of Ukraine.

Lengthy spells of dry weather in large producers Canada and the US have also added pressure to wheat prices.

Overall, international food prices rose slightly – by just 1.3% – in July, and remain some 12% lower than the FAO’s food price index a year earlier, as the cost of sugar slid, and there were small falls in the prices of dairy and meat, all of which should ease some pressures on consumers amid stubbornly high food price inflation in many countries.