Layer 2 solutions have been growing over the last year. More L2 blockchains launched. We see EVM Rollups, sidechains, or Validium’s that use zk-proofs. Vitalik Buterin has for a long time been supporting L2 blockchains. He wrote a blog about some of the issues that L2 blockchains and their bridges face.

So, let’s take a closer look at this stimulating blog about L2 blockchains. When Vitalik writes, it’s worth checking it out.

L2 Blockchains Are Becoming More Diverse

Buterin sees more L2 blockchains joining the L2 ecosystem. The main features that L2 blockchains provide are fast and cheap transactions. Ethereum’s users are happy to see gas fees around $0.10 instead of $2 on a good day. However, how can you explain to a Web2 user who never paid any transaction fees, that he needs to pay $0.10? Centralized apps and small L1 chains may experience similar issues.

Different types of layer 2shttps://t.co/ry4VTtWhJ1

— vitalik.eth (@VitalikButerin) October 31, 2023

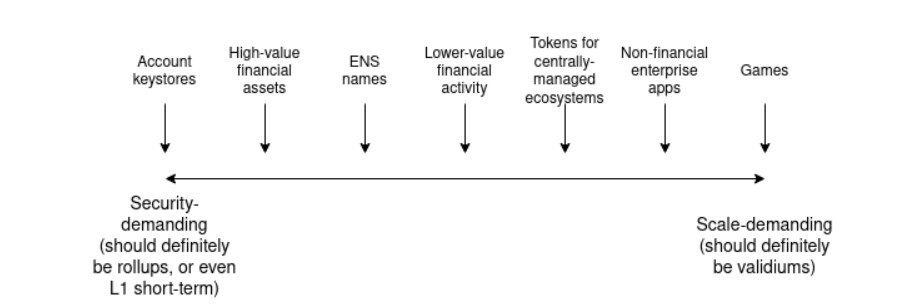

This is where Buterin sees a challenge in his blog. So, he distinguishes between three different types of L2 blockchains. But everyone, building a Layer 2 chain, needs to find a balance between the trade-offs. These trade-offs are for centralized apps to become more decentralized. This would make them more secure. However, with a high throughput, rollups couldn’t handle this.

On the other hand, games and social media like the decentralization aspect. But, they can handle a lower security level. For example, losing a post due to chain issues is acceptable. But, losing your account would be a more serious issue.

There are also current L1s, that want to move closer to Ethereum. They can do this on a step-by-step basis. They may want to become an L2. Currently, roll-up technology can’t handle all their requirements. That’s why they need to find a balance by starting to transition before it’s too late. In that case, they lose momentum.

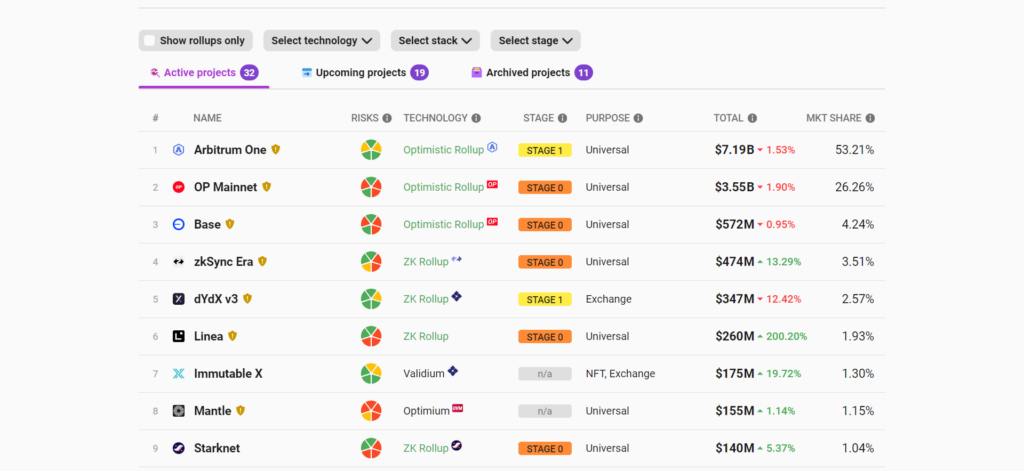

Here’s an interesting website, that shows you the current level of where an L2 blockchain is at. It allows you to keep track of their progress. It breaks it down into various features, like, risk, technology, stage, and more. See the picture below.

Source: L2 Beat

The Tradeoff Between Security and Scalability

The next issue Buterin discusses is the tradeoff between security and scalability. He mentions the following situation.

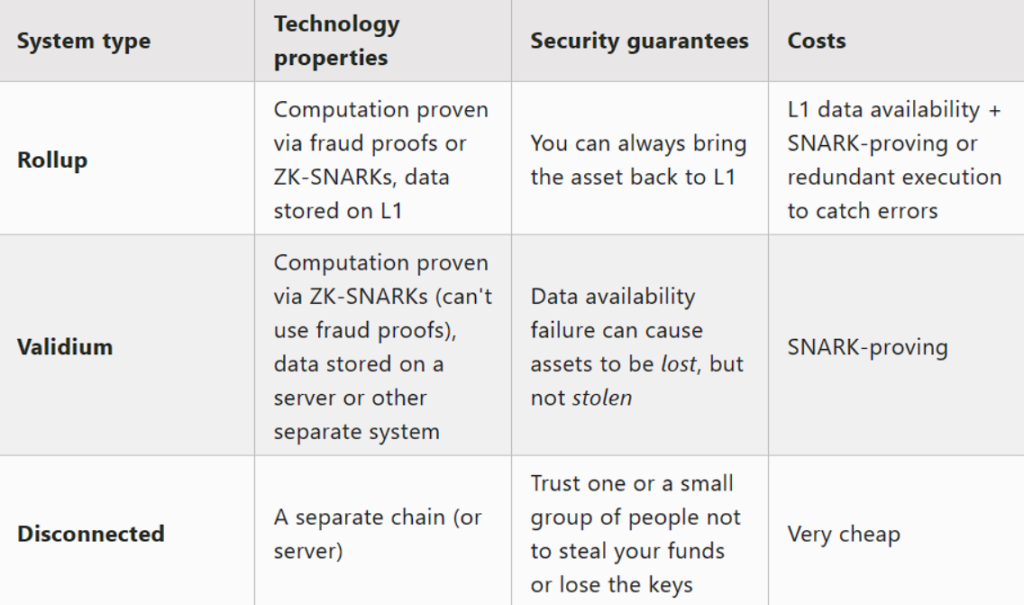

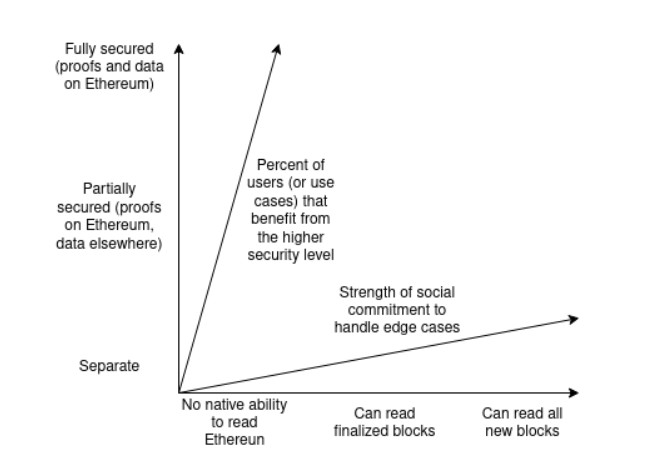

An L1-issued asset gets deposited on an L2. Now, you receive this asset and send that asset back to the L1? This raises other questions. For example, what tech should an L2 choose to do this and are there any tradeoffs? Here’s a chart that covers this narrative.

However, he also points out that there are intermediate options available. For instance, between rollups and validium or between plasma and validium. This works like a gliding scale. He sees two major factors, in why L2s make their decisions in this scalable spectrum.

The cost of Ethereum’s native data availability. Technology will improve, which will result in decreased costs. This should also improve with the introduction of sharding. However, all the current intermediary options, have tradeoffs. The following chart shows these tradeoffs.

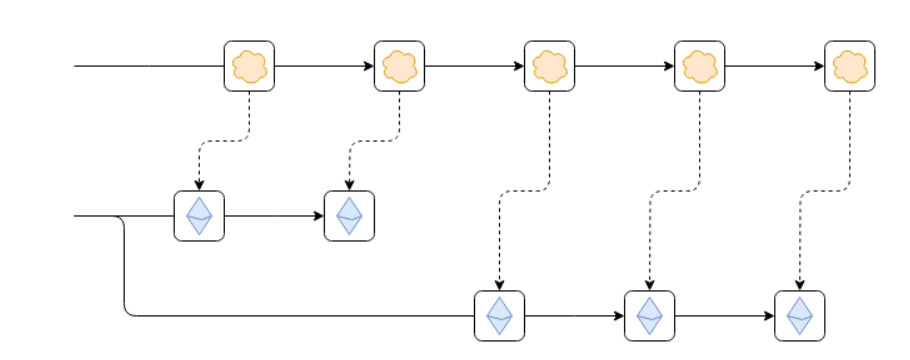

Trustlessly Reading Ethereum

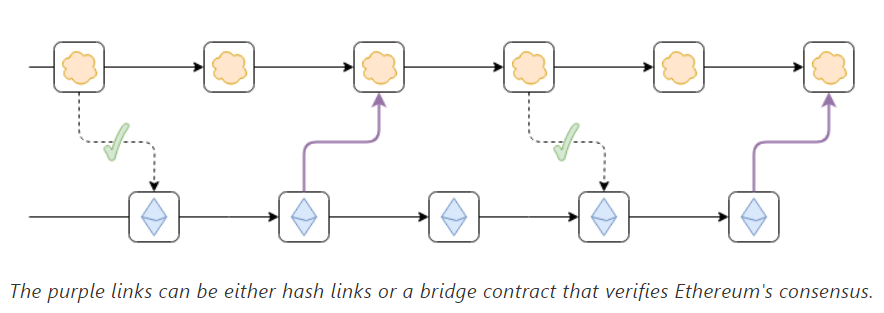

Can L2s read Ethereum? Look at it this way, can an L2 revert, if Ethereum reverts? Ethereum could revert, for example, when the chain hasn’t finalized. However, you already deposited funds. Now, the L2 block keeps reading from the reverted block and does not form any new Ethereum blocks. This makes for a perfect, endless money printer. See the picture below.

L2 blockchains can solve this in two ways. By either:

- Only allow reading of finalized blocks of Ethereum. This is the easier option. However, with a prolonged inactivity leak period on Ethereum, the L2 loses functionality.

- The top chain (L2) can revert if Ethereum reverts. This is the best solution, but harder to install.

So, all the points mentioned, reinforce that each choice has a tradeoff. Now. Buterin also raises the question if having a bridge makes you a validium. Well, the short answer is not outright. Let’s look back at the sample above. There’s still the issue that a chain may need a hard fork in case of reverting. This allows them to keep communicating with each other.

As a solution, he offers a hard fork. This requires social commitment. For example, an exceptional situation in Ethereum happens. As a result, the bridge doesn’t work anymore. Now, the other chain needs to complete a hard fork. This allows the bridge to communicate with both chains it connects. See the picture below.

Conclusions

Buterin sees two key dimensions to ‘connectedness to Ethereum’. That’s the security of:

- Withdrawing to Ethereum.

- Reading Ethereum.

He sees both as being important. He managed to show this in a spectrum, as shown in the picture below:

Now, apps can be anywhere in this spectrum. It all depends on how they weigh security vs scalability. This brings us back to the circle of tradeoffs.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post Vitalik Buterin’s Latest Guide to L2 Blockchains appeared first on Altcoin Buzz.